- Bitcoin is in a cooling phase, with strong ETF inflows and long-term holder accumulation helping defend the crucial $100K support level.

- A drop below $100K could shift market sentiment into a corrective phase, while current on-chain signals suggest bulls still maintain control.

Bitcoin (BTC) is currently in a “cooling down” phase, not yet entering a full correction. While institutional short bets and geopolitical tension have applied some downward pressure, strong ETF inflows and long-term holder accumulation remain supportive of bullish sentiment—making the $100K support level a critical line in the sand.

Market Volatility Tests Support

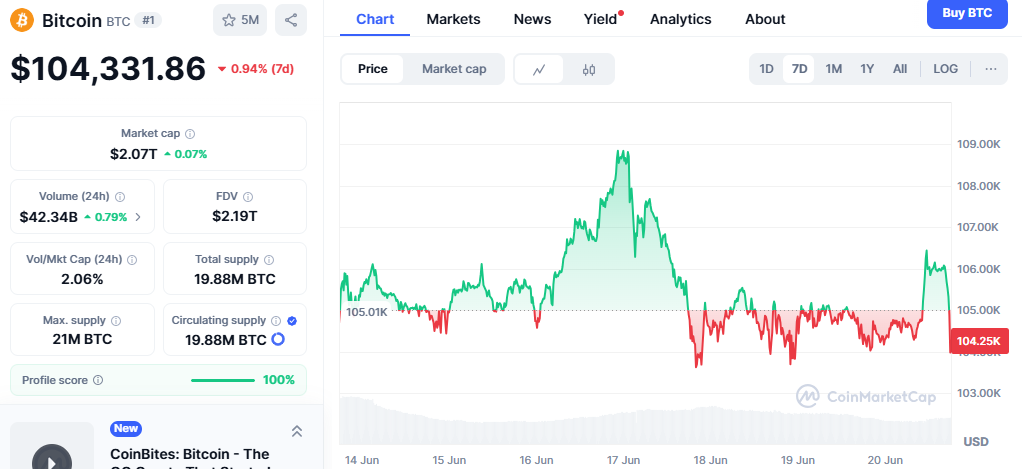

In the past 24 hours, Bitcoin dipped twice to $104K, before recovering slightly to trade around $104.6K at press time. This short-term volatility was largely anticipated, with analysts pointing to the gap between spot and perpetual futures as evidence of institutional shorting activity.

Meanwhile, despite ongoing tensions in the Middle East, Bitcoin’s price action has largely shrugged off geopolitical concerns after an initial bearish reaction. The $102.5K support level is now the immediate battleground for bulls and bears alike.

Also read: XRP Price Poised for Breakout as Analyst Highlights 4 Key Bullish Signals

Heat Macro Phase Signals Normal Activity

According to analyst Axel Adler Jr’s weekly report, Bitcoin’s Heat Macro Phase—an index combining four key on-chain signals—shows the market is not in overheated territory.

The index peaked at 0.45 in late May when BTC touched $111K, then cooled to 0.39 in early June during accumulation around $101K. Currently at 0.41, the index suggests normal demand levels. A drop below 0.39, combined with a price break under $100K, would signal a shift into a true corrective phase.

HODLers Provide Market Backbone

Despite the cooling market, long-term Bitcoin holders continue accumulating. Data from CryptoQuant’s spot taker CVD over the past 90 days shows taker buy volume remains dominant—contrasting sharply with the heavy selling seen in late 2024.

This steady accumulation by long-term investors and continued ETF inflows suggest that bulls still have hope for a recovery, as long as Bitcoin holds above the $100K threshold.