- The cryptocurrency market is showing remarkable resilience, with Bitcoin, Ethereum, and XRP leading a strong rebound despite escalating geopolitical tensions between Israel and Iran.

- This recovery is underpinned by significant institutional investment and a surge in derivatives open interest, signaling renewed confidence among traders

Despite escalating geopolitical tensions in the Middle East, the cryptocurrency market is demonstrating remarkable resilience, with Bitcoin (BTC), Ethereum (ETH), and XRP leading a broad recovery. This resurgence follows a volatile Friday marked by instability triggered by the conflict between Israel and Iran, which has since seen further escalation.

Bitcoin, the bellwether of the crypto market, has extended its gains, comfortably hovering above the $107,000 mark. This represents a more than 4% increase from its Friday low of $102,664. The impressive rebound is further underscored by a significant surge in Bitcoin derivatives open interest, which has soared to $72 billion. Trading volumes for BTC have also neared $60 billion in the last 24 hours, signaling a robust return to risk-on

sentiment among investors.

Also read: Meme Coins Surge: DOGE, SHIB, PEPE Lead Crypto Market Recovery

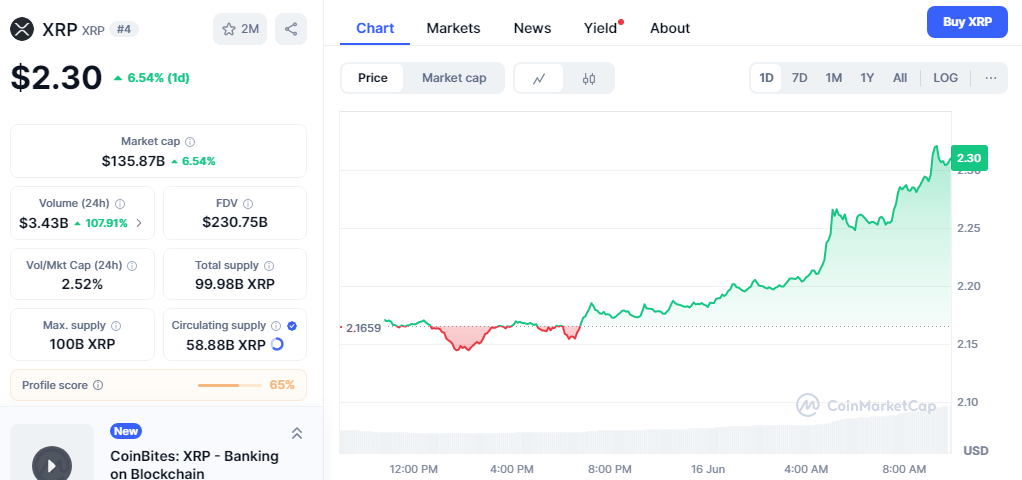

Ethereum and XRP are also showing strong signs of recovery, bolstered by increased institutional interest and steady inflows into related financial products. Ethereum, in particular, saw a remarkable $583 million in inflows last week, its strongest performance since February, pushing its assets under management (AUM) to $14.9 billion. XRP, not to be outdone, recorded over $11.8 million in weekly inflows, eyeing a potential breakout from a descending channel.

This sustained influx of capital into digital asset investment products paints a picture of growing confidence. According to CoinShares’ latest report, cumulative inflows reached $1.9 billion last week, marking the ninth consecutive week of positive flows and a record year-to-date total of $13.2 billion. This institutional accumulation, as highlighted by QCP Capital, with firms like Metaplanet and Strategy actively “buying the dip,” suggests a robust underlying demand for digital assets even amidst global uncertainty.

The derivatives market, which experienced massive liquidations exceeding $1 billion on Friday, has also ticked up over the weekend. The increase in Bitcoin’s Open Interest, alongside a 28% surge in trading volume, indicates that traders are increasingly willing to bet on Bitcoin’s price recovery, defying the broader geopolitical jitters. Technical indicators for Bitcoin remain bullish, with the 4-hour Moving Average Convergence/Divergence (MACD) flashing a buy signal, and the Relative Strength Index (RSI) moving towards overbought territory, potentially paving the way for a test of the $110,000 resistance level.

While volatility remains a key concern for traders this week, the current market dynamics suggest that the crypto ecosystem is proving its mettle, demonstrating a newfound maturity in navigating turbulent global events.