- Bitwise CEO Hunter Horsley warns Bitcoin could face future competition from alternative 10x opportunities and a fading digital gold narrative

- Despite potential headwinds, BTC ETFs saw $10B in Q2 inflows, outperforming gold and delivering a 58% year-on-year gain.

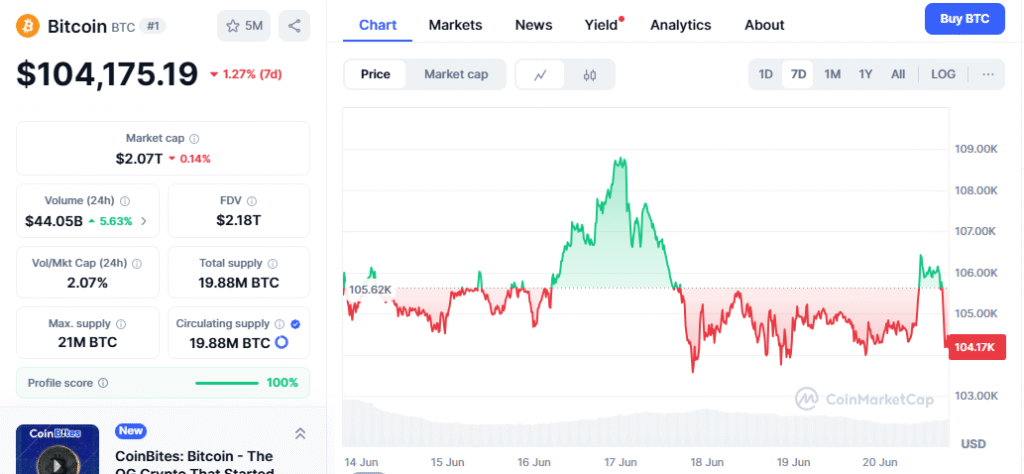

Bitcoin (BTC) has been on a tear in 2025, surging from $40K to $75K on the approval of U.S. spot ETFs and climbing above $100K under pro-crypto policies from the Trump administration. However, Bitwise CEO Hunter Horsley has cautioned that BTC could face fresh headwinds in the coming quarters.

In a recent market update, Horsley identified two key challenges: competition from “alternative 10x opportunities” and a “fading” digital gold narrative among institutional investors.

“These two aren’t the most pressing items of this moment, but they will reveal themselves as the next obstacle over the coming quarters,” Horsley warned.

Also read: Scaramucci Predicts Solana Will Flip Ethereum — Can SOL Really Overtake ETH in Market Cap?

BTC ETFs Outshine Gold in Q2

Despite the looming challenges, Bitcoin continues to enjoy robust institutional demand. BTC ETF net inflows surged to nearly $10 billion in Q2, rebounding strongly from $3.3 billion in outflows earlier this year.

In contrast, gold ETFs saw a sharp 50% decline in inflows, dropping from $30 billion to $15 billion in the same period, according to data from Bold Report.

While some view BTC and gold as rivals, Horsley believes both will remain complementary as “apolitical stores of value (SoV).” The real competition, he suggests, will come from U.S. Treasuries and government bonds.

“Rather, I think Bitcoin’s competition is going to end up being U.S. Treasuries and other governments’ bonds (eg, UK gilts): the ultimate political SOVs,” he added.

BTC Still Outperforming Gold in 2025

In terms of returns, BTC has outshined gold so far this year. From April, Bitcoin outperformed gold by 34%. Although gold has outpaced BTC by 10% since mid-May, Bitcoin’s overall momentum remains strong.

The BTC/Gold ratio—a key indicator of BTC’s relative performance—rose just 1.5% this week amid Middle East tensions, showing Bitcoin’s resilience.

Year-on-year, BTC is up an impressive 58%, far exceeding the S&P 500’s 11% and gold’s 46%. Should the BTC/Gold ratio extend toward the 40 level, Bitcoin could deliver even stronger returns relative to gold.

As Horsley cautions, BTC may face new competition ahead, but for now, institutional investors are still betting big on Bitcoin.