- Bitcoin exchange inflows, especially from Binance whales and retail investors, have hit historic lows, signaling strong holding behavior and growing market confidence despite geopolitical tensions.

- This reduced selling pressure, combined with increased buying activity, has helped BTC break above $107,000, with potential to climb further if bullish momentum continues.

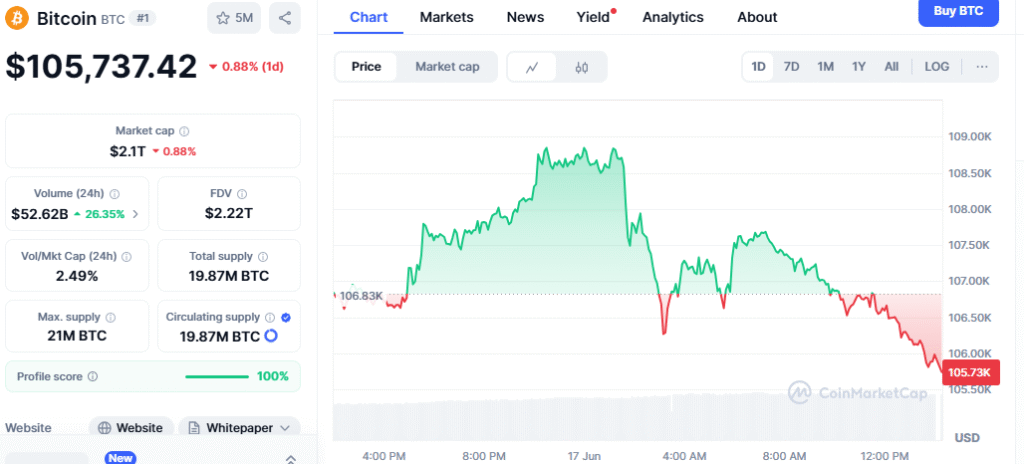

Bitcoin has once again defied bearish expectations, surging past $107,000 after a brief period of consolidation — a move that reflects a broader trend of increasing market confidence, particularly from Binance whales and retail investors.

According to data from CryptoQuant and IntoTheBlock, inflows of Bitcoin to Binance — often a signal of incoming sell pressure — have dropped to historical lows. This rare alignment between whale and retail investor behavior marks a new phase of strong “HODLing,” a term popularized in the crypto world to signify long-term holding regardless of market volatility.

Also read: Ripple and SEC Request 60-Day Appeal Pause Amid Ongoing Settlement Negotiation

This trend suggests that both large-scale investors and smaller traders are bracing for further price appreciation. Amid ongoing geopolitical instability, particularly in the Middle East, Bitcoin appears to be benefiting from its reputation as a digital safe haven. The lack of selling pressure, paired with increasing withdrawal activity, signals that investors are positioning themselves for a potential breakout rather than a selloff.

Notably, the Large Holders Netflow to Exchange Ratio has flattened to zero in recent days, according to IntoTheBlock. This metric is a clear indicator that whales are not only avoiding depositing BTC onto exchanges — typically a precursor to selling — but are also actively withdrawing, further reducing available supply and intensifying upward price pressure.

The broader market is also showing bullish sentiment. Bitcoin’s Taker Buy-Sell Ratio has turned positive again, hitting a monthly high. This reflects a surge in market demand, with buyers now overwhelming sellers — a key driver behind Bitcoin’s recovery from $102,000 to its recent high of $107,251.

Historically, synchronized investor behavior of this nature has preceded significant price rallies. If the current trend continues, Bitcoin could be poised to reclaim the $109,000 level in the near term. However, any failure by bulls to maintain momentum could see the price retreat into a tighter range between $103,000 and $105,000.

Still, the prevailing sentiment is clear: a historic dip in exchange inflows, especially from Binance users, indicates robust conviction in Bitcoin’s long-term value. Whether this will translate into another leg upward or a period of consolidation remains to be seen, but for now, the market is holding strong.