Bitcoin Drops 10% Overnight – What’s Driving the Crypto Sell-Off?

More from the Author Jane Kariuki

The cryptocurrency market has plunged, with Bitcoin dropping 10% and major altcoins like Ethereum and Solana falling over 15%, largely due to investor fears surrounding Trump’s newly imposed tariffs on China, Mexico, and Canada.

Critics, including economist Peter Schiff, accuse Trump of market manipulation through his crypto reserve announcement, leading to a massive sell-off and calls for a Congressional investigation.

The cryptocurrency market is once again in turmoil, with Bitcoin and major altcoins experiencing a significant drop in value. In just 24 hours, Bitcoin (BTC) has fallen by 10%, dragging down other top cryptocurrencies like Ethereum (ETH), Solana (SOL), and XRP, which have seen declines of over 15%. This unexpected crash has left investors scrambling for answers, with many pointing fingers at U.S. political developments, particularly recent trade policies announced by former President Donald Trump.

The Market Downtrend: What’s Happening?

After a brief rally earlier in the week fueled by Trump’s strategic reserve announcement, the crypto market is now experiencing a sharp downturn. The overall market cap has plummeted by more than 10%, settling at approximately $2.77 trillion. This coincides with a broader stock market sell-off, as the S&P 500 fell by 2% and the Dow Jones dropped 650 points in the final hours of Monday’s trading session.

The sell-off appears to be driven by investor concerns over Trump’s tariff policies targeting China, Mexico, and Canada. These tariffs, which took effect today, have sparked fears of a new global trade war, leading to increased selling pressure across financial markets. Traders are moving cautiously, bracing for potential economic instability.

Bitcoin’s 10% Crash

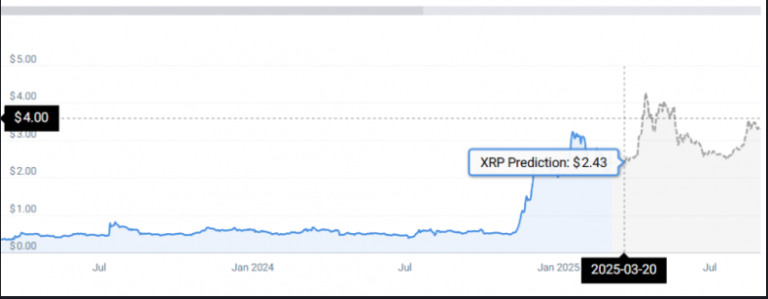

Bitcoin, the largest cryptocurrency by market capitalization, saw its price tumble from a daily high of $93,600 to around $83,300, according to CoinMarketCap data. The downturn extends beyond Bitcoin, with Ethereum losing over 11%, Solana dropping 15%, and XRP shedding 12% of its value. Meanwhile, Cardano (ADA), which was the best-performing coin just a day ago, has plummeted nearly 20% to $0.80.

Trump’s Role in the Market Turmoil

While Trump has recently positioned himself as an ally to the crypto industry, some analysts believe his latest moves have contributed to market instability. Critics argue that his announcement of a strategic crypto reserve, coupled with his ongoing memecoin project, has manipulated the market, artificially inflating prices before a massive sell-off.

Notably, economist Peter Schiff has accused Trump of orchestrating one of the biggest crypto pump-and-dump schemes in history. Schiff claims that insiders took advantage of the market surge caused by Trump’s announcement, selling off their holdings for significant profits before the market crashed. He has even called for a Congressional investigation into the matter.

What’s Next for Crypto?

With market sentiment still shaky, it remains to be seen whether crypto will recover in the coming days or face further declines. Investors are keeping a close eye on any regulatory developments or policy shifts that could impact the market. Until then, caution remains the prevailing sentiment in both the crypto and stock markets.

As the dust settles, one thing is clear: the intersection of politics and crypto remains as volatile as ever, with investors bracing for the next major development.

The post Bitcoin Drops 10% Overnight – What’s Driving the Crypto Sell-Off? appeared first on Crypto News Focus.