- Bitcoin briefly surged past $110K on softer U.S. inflation data but dipped following Trump’s tariff remarks, adding market uncertainty.

- Meanwhile, altcoins SUI and Solana show strong breakout potential, driven by ETF filings and robust on-chain growth.

Bitcoin Stumbles After Brief Surge

Bitcoin gave traders a brief jolt of excitement, shooting past $110,000 following softer-than-expected U.S. inflation data. May’s CPI showed a 2.4% increase, slightly under the 2.5% forecast, fueling hopes of a more dovish stance from the Fed. However, those gains were quickly wiped out after former President Donald Trump hinted at possible new tariffs tied to China trade talks, reigniting market uncertainty.

Now, with eyes on next week’s Federal Reserve meeting, investors are searching for less volatile opportunities. And two altcoins—SUI and Solana (SOL)—are emerging as strong contenders.

SUI Eyes ETF-Driven Breakout

SUI is quietly gaining traction, both on-chain and in the spotlight. 21Shares recently filed for a SUI Spot ETF, which is currently under SEC review. The fundamentals are even more compelling—Sui network’s trading volume has topped $100 billion, with $1.77 billion total value locked (TVL). A significant chunk of this comes from Bitcoin-linked assets and rising stablecoin activity, signaling growing user trust and adoption.

Technically, SUI continues to build on its June uptrend. The support zone between $3.27 and $3.43 remains crucial. If bulls hold this level and manage a breakout above $3.57, analysts say SUI could be poised for a powerful leg higher.

Also read: Bitcoin Price Falls Below $108K Amid Rising Geopolitical Tensions and Trade War Uncertainty

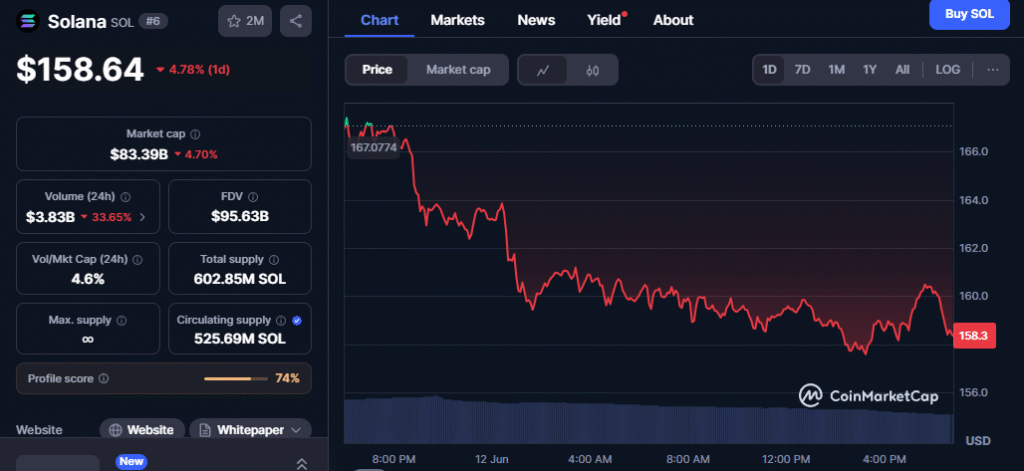

Solana Could Explode With ETF Approval

Solana isn’t far behind in the ETF race. Rex Shares and Osprey Funds are reportedly in talks with U.S. regulators to greenlight a Solana Spot ETF, with approval possibly arriving in the next 3 to 5 weeks. Analysts place the approval odds at 90%, and a green light could send SOL soaring.

Despite a 4% dip, SOL recently broke past $165, and if it clears resistance at $180, a run toward $225 could be next. For now, it’s trading at a discount—making it one of the most attractive large-cap buys in the market.

While Bitcoin reacts to macro headlines, SUI and Solana are building quietly but powerfully. With ETF filings gaining momentum and strong technical setups, these two altcoins could soon steal the spotlight.