Bitcoin Climbs the Global Asset Ladder, Achieving Top 10 Status

- Bitcoin’s market capitalization nears $1 trillion, ranking it as the 10th largest asset globally, above Tesla, Visa, and JPMorgan.

- Despite the volatility, Bitcoin’s dominance in the cryptocurrency market remains unchallenged, with Ethereum ranked significantly lower at 36th among the top 100 assets.

In an unprecedented climb within the financial arena, Bitcoin has fortified its position as a premier asset, nearing a market capitalization of $1 trillion. This advancement places it among the top 10 assets worldwide, a milestone that underscores its expanding influence and integration into the mainstream financial ecosystem.

The elevation of Bitcoin in the global asset ranking is a testament to its burgeoning acceptance and investor confidence. Surpassing stalwarts such as Elon Musk’s Tesla, Visa, and JPMorgan—with respective market caps of $947.07 billion, $616.47 billion, and $503.45 billion—Bitcoin’s ascent reflects its pivotal role and growing credibility in the financial sector.

This distinction not only highlights Bitcoin’s leadership within the realm of digital currencies but also emphasizes the significant gap between it and Ethereum, its closest competitor. Ethereum, despite being the second-largest cryptocurrency by market capitalization, is positioned at 36th, illustrating the expansive lead Bitcoin holds in the digital currency space.

Gold: The Enduring Benchmark

Amidst these dynamic shifts, gold continues to reign supreme in market capitalization, valued at $13.6 trillion. Even with a minor overnight decrease in market value, gold’s longstanding reputation as a safe-haven asset endures, underscoring its essential role in diversifying investment portfolios and safeguarding against inflation and market volatility.

Bullish Sentiment and Future Prospects

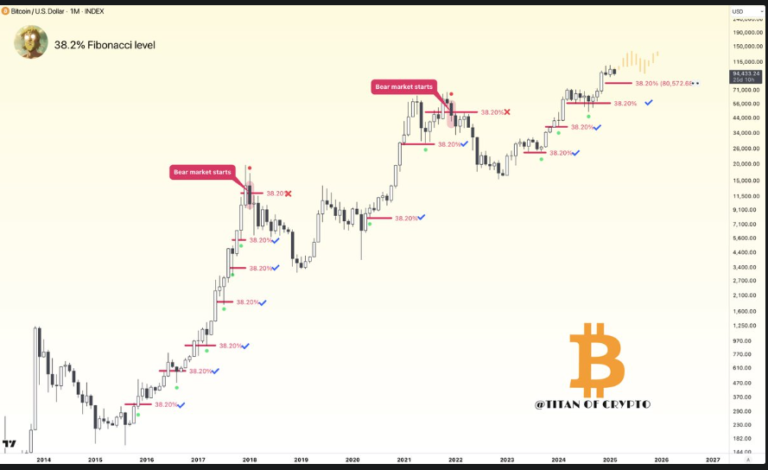

The cryptocurrency sector is buzzing with optimistic forecasts for Bitcoin, fueled by significant market movements and expert analyses. Among the voices championing Bitcoin’s potential for an upward trajectory is CryptoQuant CEO Ki Young Ju, who anticipates a striking 160% price surge. This projection points to a possible price range of $55,000 to $112,000 in the near future, bolstered by substantial inflows into the spot Bitcoin ETF market, amounting to $9.5 billion over the past month, despite notable outflows from Grayscale.

As Bitcoin continues to solidify its standing in the global financial landscape, the digital currency’s journey reflects a broader trend toward the acceptance and integration of cryptocurrencies within traditional financial systems.