- Angel investor Armando Pantoja explains that XRP doesn’t need $5 trillion in capital inflow to reach $100; instead, a relatively small investment of $20–$30 billion could drive such a price surge due to thin liquidity and market dynamics.

- He compares this to real estate, where one high-priced sale can dramatically raise the perceived value of an entire neighborhood.

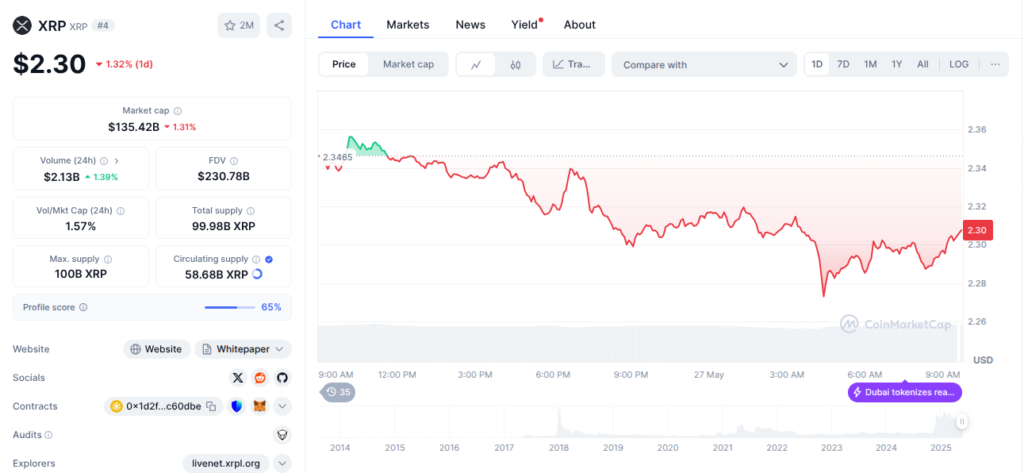

As XRP garners increased institutional interest, debates around its price potential continue to intensify. A key point of contention? Whether XRP could realistically hit $100 per coin without requiring an astronomical $5 trillion in capital inflow. Angel investor and crypto educator Armando Pantoja says yes—and explains why that assumption is deeply flawed.

In a recent analysis, Pantoja clarified the critical distinction between market capitalization and actual money inflow, a difference often misunderstood by critics and casual investors alike.

Also read: SUI Price Prediction: Bulls Hold $3.50 Support as Recovery Signals Strengthen After Cetus Hack

“Only about $20 to $30 billion would need to flow into XRP over a short period to push it toward that level,” Pantoja asserted.

He explains that market cap is calculated by multiplying a token’s current price by its circulating supply, not by tallying actual dollars invested. This means that even modest capital inflows, especially in a low-liquidity environment, can spark significant price surges and, in turn, balloon the asset’s market cap.

To drive his point home, Pantoja likened the crypto market to real estate. Imagine a neighborhood of 100 identical homes, each valued at $500,000. If one buyer, desperate to purchase, eventually pays $1 million for a single home, that transaction resets the perceived value of every house on the block—even though only one sale occurred at that inflated price. The neighborhood’s “market cap” effectively doubles, despite minimal actual cash flow.

“In a mature market, shifting prices takes a lot of capital. But crypto is still young. A little money goes a long way,” Pantoja said.

This analogy underscores a key insight for XRP investors: price does not require proportionate investment. Thin liquidity and strong demand can create the conditions for dramatic appreciation.

Pantoja concludes that the idea of XRP hitting $100 is not fantasy—it’s a viable outcome, provided market conditions align.

This article is for informational purposes only and does not constitute financial advice. The views expressed are those of the source and not necessarily those of The Crypto Basic. Always conduct your own research before making investment decisions.