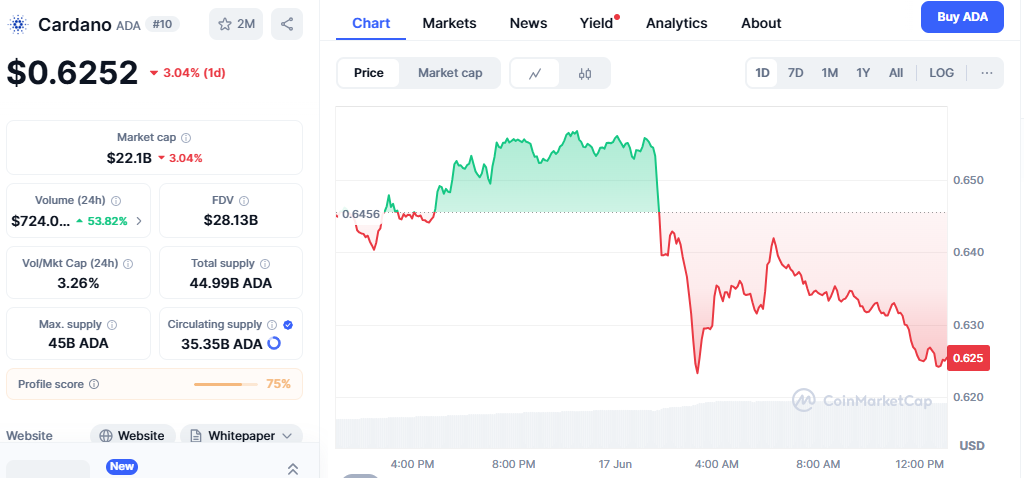

- Cardano proposal to swap $100 million of ADA for Bitcoin has heightened concerns among experts that altcoins may continue to lose ground as investors favor BTC, potentially delaying a broader altcoin rally.

- Despite Bitcoin’s rising dominance, a few select altcoins like Hyperliquid and Pepe have outperformed BTC significantly, offering isolated opportunities amid a generally challenging market for altcoins.

The crypto community is buzzing as market veterans warn that the so-called altcoin season might be slipping further out of reach, fueled by Cardano’s recent proposal to swap $100 million of cardano for Bitcoin (BTC) in a strategic treasury diversification move.

Despite the notable rise in Bitcoin’s market dominance throughout 2025, some altcoins continue to outperform BTC, sparking mixed signals about the sector’s health. However, prominent voices like Bitwise’s Head of Alpha Strategies, Jeff Park, and Blockstream founder Adam Back, caution that this trend could be temporary or even worsen.

Park expressed skepticism on social media, reacting to Cardano founder Charles Hoskinson’s announcement with a dose of irony: “Subpar altcoins ditching their own assets to build a BTC treasury was not on my 2025 bingo card. World is healing.” His comment underscores a growing concern that protocols are abandoning their native tokens in favor of Bitcoin, signaling a retreat from altcoins to the safety of BTC.

Adam Back echoed this sentiment more bluntly, warning of an impending altcoin market crash. He suggested Cardano’s move might accelerate a broader “ALT-capitulation,” describing it as insiders dumping altcoins to fund Bitcoin slush funds. This could mean the end of any near-term altcoin season, with investors flocking to BTC amid uncertainty.

The numbers support their caution. Since last November’s brief altcoin rally, the broader altcoin market has dropped roughly 50% against Bitcoin. A long-term chart tracking the altcoin-to-BTC ratio reveals a steady decline since 2021, indicating sustained investor preference for Bitcoin over alternative tokens.

Bitcoin’s market dominance paints a clear picture: it surged from 55% to 65% in recent months, meaning more than half of the entire crypto market capitalization now rests with BTC. This dominance often signals that investors view Bitcoin as a safer, more reliable asset amid turbulent market conditions.

Yet, it’s not all gloom for altcoins. Certain tokens like Hyperliquid (HYPE), Aave (AAVE), Monero (XMR), Bittensor (TAO), and Pepe (PEPE) have delivered exceptional returns—some outperforming Bitcoin by up to 20 times over the past 90 days. HYPE, notably, surged 200% against BTC’s modest 22% gain.

In summary, while Bitcoin’s dominance and Cardano shift to BTC treasuries hint at continued challenges for altcoins, select projects still offer significant upside potential. Investors hoping for a broad altcoin season rally may need to temper expectations, focusing instead on standout performers within a cautious market landscape. The next phase of crypto could well hinge on how protocols balance treasury diversification with confidence in their native tokens.