Key Takeaways

- A crypto exchange is a platform for buying, selling, and trading digital assets like Bitcoin, Ethereum, and altcoins.

- In 2025–2026, exchanges are evolving with advanced features such as decentralized trading, tokenized assets, and institutional-grade security.

- Understanding how crypto exchanges work is essential for safe participation in the rapidly expanding digital finance ecosystem.

Introduction: The Central Role of Crypto Exchanges in 2025–2026

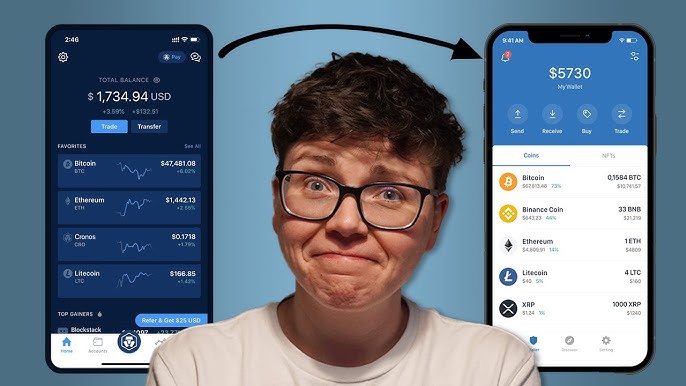

The question “What is a crypto exchange?” has become a starting point for anyone entering the digital finance world. In 2025 and 2026, cryptocurrency trading is no longer a niche activity; it’s an essential component of global finance. Crypto exchanges serve as digital marketplaces where users can buy, sell, or trade cryptocurrencies.

As blockchain technology matures, exchanges have evolved beyond simple trading platforms. They now offer lending, staking, derivatives trading, and access to tokenized real-world assets. With billions in daily trading volume, understanding crypto exchanges is critical for navigating the decentralized finance (DeFi) and Web3 ecosystem safely.

The Core Concept: Centralized vs Decentralized Exchanges

Crypto exchanges can generally be divided into two categories:

Centralized Exchanges (CEXs)

Centralized exchanges are run by companies that act as intermediaries between buyers and sellers. Examples include Binance, Coinbase, and Kraken. Key features include:

- User-friendly interfaces for beginners

- High liquidity and fast transactions

- Custodial wallets, where the exchange holds the private keys

While convenient, centralized exchanges require trust in the platform’s security and regulatory compliance.

Decentralized Exchanges (DEXs)

Decentralized exchanges operate without a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap enable peer-to-peer trading directly on blockchain networks.

- Users retain control of their private keys

- Trades are executed via smart contracts

- No single entity can freeze funds or restrict access

DEXs have grown significantly in 2025–2026 due to demand for privacy, self-custody, and censorship-resistant trading.

How Crypto Exchanges Work

At a basic level, crypto exchanges match buyers and sellers. On centralized exchanges, this happens through an order book system or market makers. On decentralized exchanges, smart contracts automate the process using liquidity pools.

Additional features common in modern exchanges include:

- Spot Trading: Buying and selling crypto at current market prices

- Margin and Derivatives Trading: Using leverage to amplify gains or hedge positions

- Staking and Yield Products: Earning interest on crypto holdings

- Token Listings: Access to newly minted cryptocurrencies and NFTs

These functions are increasingly integrated with regulatory compliance measures, making exchanges more accessible to institutional investors.

Why Crypto Exchanges Are Critical in 2025–2026

Crypto exchanges are no longer just trading venues—they’re hubs for digital financial innovation. Key trends include:

1. Institutional Participation

Banks, hedge funds, and investment firms now trade through regulated crypto exchanges. This increases liquidity and stabilizes markets.

2. Integration with DeFi

Many centralized exchanges are bridging with decentralized protocols, allowing users to access DeFi yields and tokenized assets without leaving the platform.

3. Advanced Security

Exchanges are deploying multi-layered security systems, including hardware wallets, multi-signature authentication, and AI-based fraud detection.

4. Real-World Asset Tokenization

2025–2026 sees growing adoption of tokenized equities, bonds, and commodities on crypto exchanges, bringing traditional finance into the blockchain ecosystem.

Risks and Considerations

While crypto exchanges offer opportunities, users must navigate risks carefully:

- Security Threats: Hacks, phishing, and mismanagement can result in lost funds

- Regulatory Uncertainty: Local laws affect how exchanges operate and what services they can offer

- Volatility: Cryptocurrency markets are highly volatile, and leverage can amplify losses

Understanding the difference between centralized and decentralized exchanges and practicing good security habits is essential.

Conclusion: Crypto Exchanges as Gateways to the Digital Economy

Understanding what a crypto exchange is is a critical step in participating safely in the digital finance ecosystem of 2025–2026. Whether centralized or decentralized, these platforms provide access to a rapidly growing world of cryptocurrencies, tokenized assets, and Web3 applications.

As technology advances and regulatory frameworks stabilize, crypto exchanges will continue to serve as the gateway for both retail and institutional users to participate in the decentralized financial future.