Key Takeaways

- Ethereum price drop mirrors 2020 correction, hinting at a repeat rally.

- Whale accumulation near $3,200 supports bullish sentiment.

- Analysts project a target zone of $4,500–$4,800 if support holds.

- MACD golden cross and liquidity setup reinforce recovery potential.

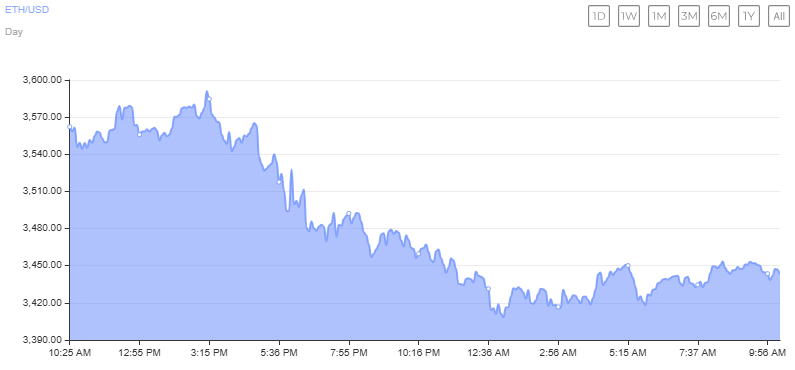

Ethereum (ETH) has entered a familiar phase in its market cycle. After falling sharply from its November highs, the second-largest cryptocurrency by market cap is showing signs of recovery that mirror the 2020 correction. Analysts believe this déjà vu moment could precede another major rally — potentially propelling ETH back toward the $4,800 mark.

Ethereum’s 2025 Price Action Echoes 2020 Market Reset

In recent weeks, Ethereum’s price slid from $4,960 to just above $3,000, sparking fears of a deeper correction. However, analysts are pointing to the striking similarity between the 2025 downturn and Ethereum’s 2020 retracement — when ETH dropped from $490 to $308 before staging a powerful breakout.

Crypto analyst Galaxy highlighted that Ethereum bounced strongly after that 2020 dip, marking the start of a long bull run. Drawing a parallel, Galaxy noted ETH’s rebound from $3,064 in November 2025 as a potential early signal of another surge. With ETH now trading above $3,500, the setup could once again be primed for upside momentum.

Analysts Eye $4,500–$4,800 as Next Key Target

Several leading analysts see Ethereum’s $3,000–$3,400 zone as critical support. PRIME X reported that whale wallets have been accumulating ETH around $3,200, viewing it as a strong entry level. Historically, such accumulation has preceded market rallies.

Meanwhile, Bitconsensus identified $4,950 as the next liquidity zone — a level likely to attract significant trading activity. A successful move toward this target could reignite bullish sentiment and drive ETH closer to its previous highs.

Technicals Signal Bullish Divergence

Ethereum’s technical indicators are also flashing green. The daily chart shows ETH holding trendline support from April 2025, with a bullish MACD golden cross forming. Combined with rising trading volumes — up 24.2% daily to $39.8 billion — these factors point to renewed market strength.

Also Read; How to Launch a Token on Ethereum

Ethereum Next Bull Phase Could Be Brewing

Despite short-term volatility, Ethereum’s long-term structure remains intact. The combination of whale activity, technical strength, and historical price patterns suggests ETH may be preparing for its next major leg upward. If the $3,000–$3,400 range continues to hold, Ethereum could mirror its 2020 rebound — this time, targeting new highs beyond $4,800.