Key Takeaways:

- Crypto debit cards let you spend cryptocurrency like regular cash.

- You can top up, convert, and track crypto payments in real time.

- Choosing the right card depends on fees, supported coins, and rewards.

How to Use a Crypto Debit Card: Turning Crypto into Cash

As cryptocurrency adoption grows in 2025, crypto debit cards are becoming one of the most practical ways to use digital assets in everyday life. Instead of holding crypto in wallets or exchanges, these cards allow you to spend your holdings like traditional money, whether online or in-store.

Crypto debit cards function similarly to standard debit or prepaid cards but are backed by cryptocurrencies like Bitcoin, Ethereum, and increasingly popular altcoins. With many providers now offering cards in 2025, understanding how to use them effectively is crucial for maximizing convenience and avoiding unnecessary fees.

Setting Up Your Crypto Debit Card

The first step is to select a card that suits your needs. Key considerations include supported cryptocurrencies, fees, rewards, and geographical availability. Popular options in 2025 often allow multiple coins, with some even offering stablecoin support to reduce volatility risks.

Once you choose a card, the setup process generally involves:

- Creating an account with the provider and completing KYC (Know Your Customer) verification.

- Linking your crypto wallet or exchange account. Some cards let you top up directly from your existing wallet, while others require conversion to a specific crypto before funding.

- Activating your card through the provider’s app, where you can also set spending limits and security features such as PIN codes or biometric authentication.

After setup, your card is ready for everyday transactions.

How Crypto Debit Cards Work in Practice

Using a crypto debit card is straightforward but slightly different from traditional banking. Each time you make a purchase, your crypto is automatically converted into the local fiat currency at the point of sale. This eliminates the need for manual conversions and ensures seamless spending worldwide.

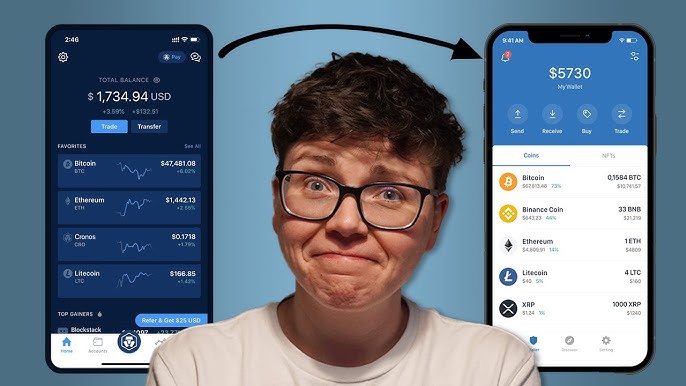

Many cards also come with mobile apps that allow users to:

- Monitor real-time balances across multiple cryptocurrencies.

- Convert between coins instantly before making purchases.

- Track transactions and rewards in one unified dashboard.

In 2025, some providers have added enhanced features like recurring payment support, crypto cashback programs, and integrated budgeting tools to help users manage spending in volatile markets.

Choosing the Right Card: Fees and Rewards

While convenience is key, understanding fees is essential. Common costs include:

- Transaction fees for purchases or ATM withdrawals.

- Conversion fees when your crypto is converted to fiat.

- Monthly or annual card maintenance fees, depending on the provider.

Rewards can also vary. Many crypto debit cards offer cashback in crypto, bonus points, or discounts at partner merchants. In 2025, these rewards are increasingly tailored to crypto users, including incentives for staking or holding specific tokens.

Choosing the right card requires balancing fees with benefits. For example, if you frequently travel internationally, a card with low conversion fees and broad currency support may outweigh higher cashback percentages.

Security and Best Practices

As with all crypto services, security is paramount. Best practices in 2025 include:

- Enabling two-factor authentication on card accounts.

- Keeping wallets and keys secure, preferably in hardware wallets when not in use.

- Monitoring spending activity for unusual transactions.

Some crypto debit cards now integrate real-time fraud alerts and temporary virtual card numbers for safer online purchases, reflecting growing innovation in the sector.

The Future of Crypto Debit Cards

In 2025 and 2026, the adoption of crypto debit cards is expected to expand as more merchants and platforms accept crypto payments. With enhanced features like instant conversion, staking rewards, and multi-coin support, these cards are becoming a bridge between decentralized finance and everyday spending.

As regulatory frameworks evolve, users may see lower fees, greater protection, and broader acceptance worldwide. For now, crypto debit cards remain an ideal tool for anyone looking to turn digital assets into real-world purchasing power without sacrificing convenience or security.

Conclusion

Using a crypto debit card in 2025 transforms how you spend and manage digital assets. By understanding setup processes, transaction mechanics, fees, rewards, and security measures, you can confidently integrate crypto into your daily life. Whether you’re traveling, shopping online, or looking to earn crypto rewards, a crypto debit card is one of the most practical tools to bring the promise of blockchain into everyday spending.