- Ethereum network activity, whale accumulation, and rising scarcity metrics are strengthening its fundamentals despite range-bound price action.

- If these trends persist, ETH could soon break above the $2,800 resistance and enter a bullish phase.

Ethereum [ETH] is quietly building momentum beneath the surface. Recent on-chain data shows that rising adoption, increasing scarcity, and renewed whale accumulation may set the stage for a long-awaited breakout above the stubborn $2,800 resistance.

Since mid-May, Ethereum’s weekly new wallet creation has surged, consistently ranging between 800,000 and 1 million addresses—up sharply from the 560,000–670,000 range during the same period last year, according to Santiment data. This growing user base suggests that Ethereum’s network fundamentals are strengthening, potentially providing a more solid foundation for long-term price appreciation.

Also read: Bitcoin Whale Activity Drops 191% — Is BTC Headed for a Correction?

Large holder activity is also flashing bullish signals. After weeks of muted whale flows, netflows have spiked over 7,400% in the past week, as reported by IntoTheBlock. This renewed accumulation trend may reflect growing confidence among whales and could set the stage for a potential supply crunch—especially if buying pressure continues to outpace new issuance.

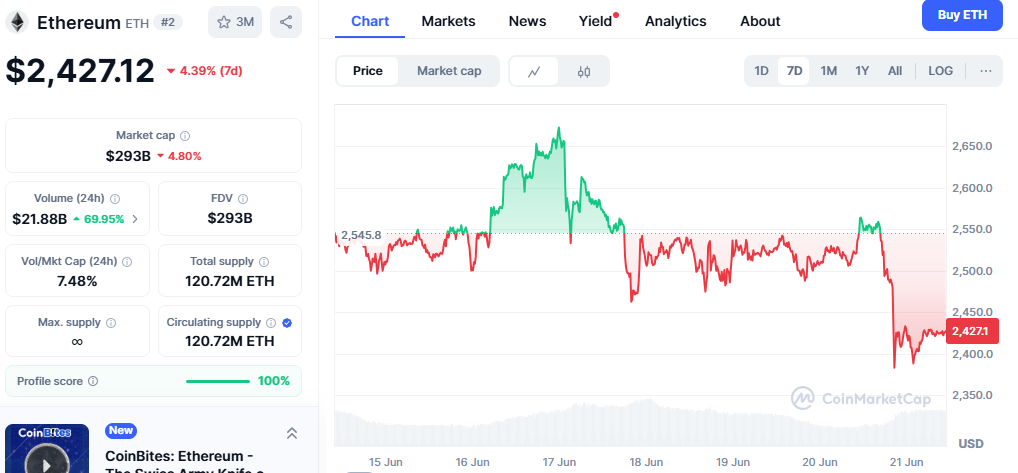

Despite this underlying strength, Ethereum’s price remains locked in a consolidation phase. ETH has traded between $2,396 and $2,833 for several weeks, moving within an ascending channel. While bulls have yet to reclaim the $2,833 level, bears have also failed to push the price below $2,396—a classic sign of indecision that often precedes a major move.

Currently, the Stochastic RSI is hovering at low levels, suggesting the potential for an upward reversal if demand accelerates. At the same time, speculative activity is cooling: the 0–1 day Realized Cap HODL Waves have declined, indicating that short-term holders may be exiting or taking profits. This reduces selling pressure and short-term volatility, further stabilizing the market.

Adding to the bullish case is Ethereum’s surging Stock-to-Flow ratio, now at 43.2—its highest in months—highlighting increasing scarcity as issuance slows.

If these trends continue, Ethereum’s growing network activity and declining speculative churn could provide the catalyst for a breakout above $2,800. The next few weeks will be crucial as ETH eyes a potential shift from consolidation to accumulation.