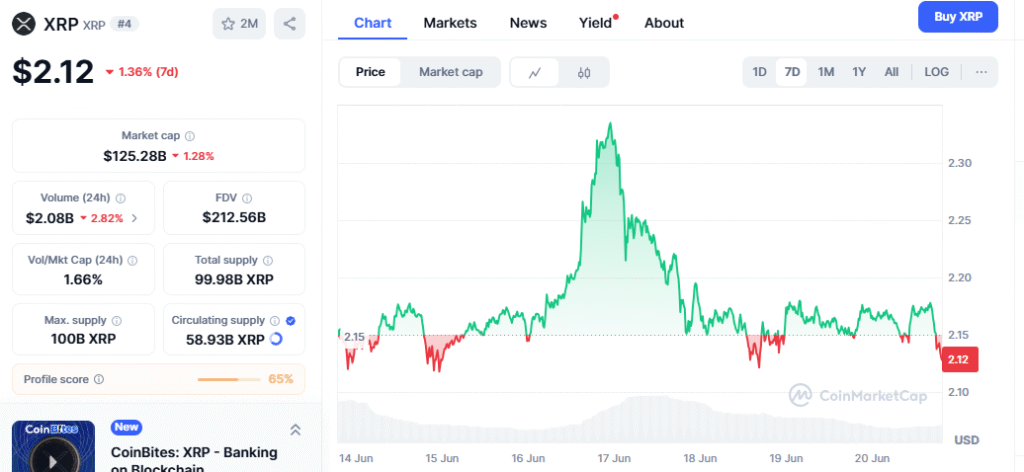

- The SEC’s aggressive appeal in the Ripple case has prompted the company to adopt a more assertive legal strategy, potentially challenging unfavorable rulings on institutional XRP sales.

- As both parties await Judge Torres’ next ruling, the outcome could set significant precedents for how digital assets are regulated in the U.S.

The ongoing legal standoff between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has reached a pivotal juncture as both sides now await Judge Analisa Torres’ decision on the revised settlement motion submitted June 12.

According to legal expert and XRP advocate Bill Morgan, the SEC’s aggressive appeal strategy may have backfired—driving Ripple to pursue a more assertive legal position than it initially planned.

How the SEC’s Appeal Shifted Ripple’s Stance

After Judge Torres’ July 2023 ruling delivered a mixed verdict—declaring XRP’s programmatic sales were not securities, while institutional sales were deemed violations—Ripple seemed prepared to accept the outcome without further challenge.

However, the SEC’s subsequent appeal of the favorable ruling on programmatic sales reignited tensions. As Morgan noted on X, “It seems likely to me that had the SEC not filed an appeal of the summary judgment decision… Ripple would not have filed an appeal on the institutional sales part… and the parties would have just moved on.”

In short, by appealing, the SEC has prompted Ripple to reevaluate and escalate its legal strategy.

Also read: Bitcoin Faces New Challenges Ahead, Warns Bitwise CEO, as BTC ETFs Outpace Gold

Ripple Moves to Offense

Ripple’s latest posture marks a shift from defense to offense. Morgan believes the SEC’s enforcement-driven approach under Chair Gary Gensler has only strengthened Ripple’s resolve: “The SEC’s new policy towards enforcement has encouraged Ripple to seek more than it would have been satisfied with.”

Now, Ripple appears determined not only to counter the SEC’s appeal but also to contest the institutional sales ruling. This aggressive strategy could set key legal precedents that will shape the U.S. regulatory landscape for digital assets.

Awaiting Judge Torres’ Next Move

Earlier this year, Ripple and the SEC submitted a proposed judgment on remedies, which was returned for procedural revision. The amended motion, filed June 12, is now before Judge Torres.

The outcome of this phase could lead to financial penalties and possible injunctions on Ripple’s institutional XRP sales. Should the ruling go against Ripple, the company has indicated a willingness to appeal.

Broader Impact on Crypto Regulation

The Ripple case continues to be a bellwether for U.S. crypto regulation. With Judge Torres’ landmark distinction between types of token sales, her upcoming ruling could either solidify or further complicate the regulatory environment.

Ironically, the SEC’s efforts to press its advantage may have emboldened Ripple—and the entire crypto industry—to push back even harder.