- XRP is consolidating around the $2.00 level within a tight symmetrical triangle, with strong support, reduced volatility, and controlled leverage suggesting a potential breakout.

- Analysts highlight that current market dynamics point to strategic accumulation, positioning XRP for a possible continuation of its broader uptrend.

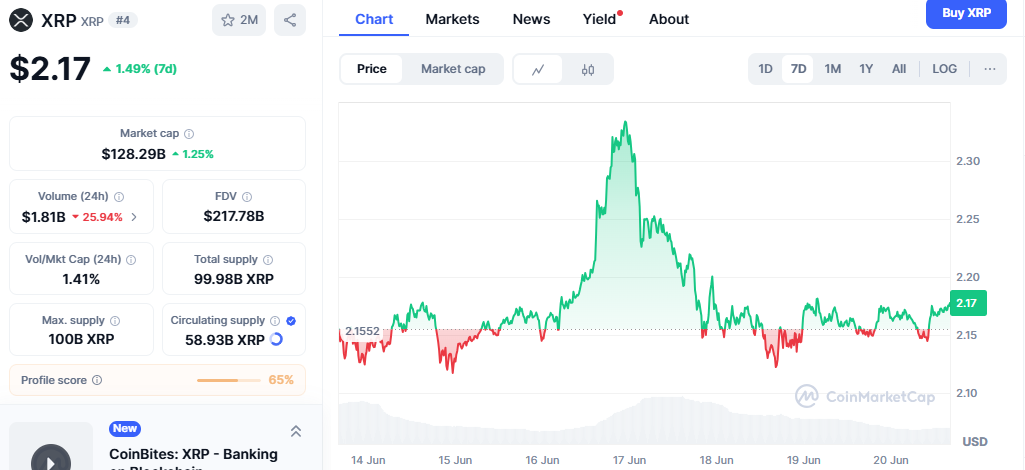

Ripple’s XRP is showing strong resilience at the $2.00 level, and technical signals now hint that a major price move could be in the making.

Currently, XRP remains trapped within a tight symmetrical triangle, as volatility steadily declines. While this range-bound action may seem indecisive, analysts suggest it could be a strategic pause before an eventual breakout.

Also read: Solana (SOL) Short Sellers on the Run — Key Factors That Could Fuel the Next Breakout

Strong Support Holds Firm

Despite several tests of the $2.00 psychological level, XRP buyers continue to defend the zone, with each dip attracting renewed accumulation. Impressively, XRP still trades nearly 300% above its pre-November 2024 base, and even during Q2’s sharp correction to $1.61, over 80% of circulating supply remained in profit.

Glassnode data further reveals that profit-taking peaked in early June at $68.8 million per day, as early holders began exiting into strength. However, the market structure remains intact—no significant breakdown has occurred.

Tight Bollinger Bands Signal Imminent Move

On the technical front, XRP has been forming higher lows since April, paired with lower highs since May—an ideal setup for a symmetrical triangle. At the same time, the Bollinger Bands have tightened considerably, pointing to diminishing volatility. Historically, this pattern often precedes explosive price action, either upward or downward.

Leverage Remains Under Control

A particularly bullish factor lies in XRP’s leverage dynamics. Open Interest (OI) remains stable in the $3–$5 billion range, far below overheated levels seen in late 2024. This suggests that current price action isn’t being driven by speculative leverage, reducing the risk of a sudden liquidation cascade.

Strategic Positioning, Not Hype

With no evidence of rampant FOMO or over-leveraged bets, the current consolidation likely represents strategic accumulation rather than a distribution top. Should sentiment shift positively, the $2.00 level could serve not only as strong support but as a potential launchpad for XRP’s next breakout.

For now, all eyes remain on whether XRP can decisively break above its triangle pattern. If confirmed, it could mark the beginning of the next major uptrend.