- Solana’s bullish sentiment is strengthening as both retail and institutional traders show increasing long positions, while short liquidations add upward pressure.

- However, a true breakout hinges on SOL reclaiming key technical levels, particularly the Bollinger Band mid-line at $152.01.

Solana’s market sentiment has flipped bullish as both retail and institutional players align on the prospect of renewed upside. But for SOL’s next move to materialize, key technical levels must still be reclaimed.

Retail and Smart Money Turn Bullish

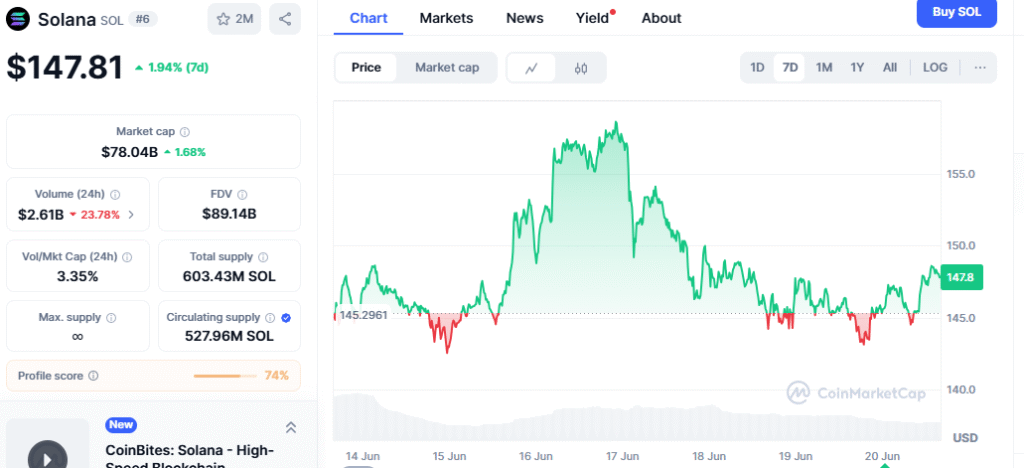

At press time, Solana [SOL] traded near $145, with sentiment indicators pointing to growing optimism. Market Prophit’s smart money sentiment score stood at 1.79, while retail crowd sentiment remained positive. Notably, the 90-day Futures Taker CVD showed a “Taker Buy Dominant” trend, suggesting persistent buy-side pressure in the market.

On Binance, data showed that 74.83% of traders were long on SOL, while 25.17% remained short. The Long/Short ratio of 2.97 highlighted the increasing bullish bias among retail traders—an encouraging sign, though one that could pose risks if not supported by a breakout.

Funding Rates Stay Balanced Amid Rising Confidence

Solana’s perpetual Futures funding rates on Binance held marginally positive, last recorded at 0.001%. This indicates that long holders are maintaining positions without excessive leverage—a key factor in keeping the current rally structurally sound.

The absence of overheated leverage allows for more sustainable upward momentum, minimizing the risk of sudden, volatile corrections.

Short Liquidations Add Fuel

Recent data reveals a noticeable skew toward short liquidations, with $192K worth of shorts wiped out on June 20th. Binance and OKX accounted for $68K and $102K in short liquidations, respectively. This squeeze effect could continue to drive incremental price gains if sellers remain offside.

Technical Outlook: Can SOL Break Out?

Currently, SOL remains range-bound between $140 and $152, just beneath the Bollinger Band mid-line resistance at $152.01. Flattening MACD values at -3.26 signal waning bearish pressure, while the narrowing Bollinger Bands suggest reduced volatility—often a precursor to a breakout.

For a sustained bullish move, Solana needs to reclaim the 20-SMA mid-band and turn it into support. Until that happens, momentum remains latent but well-supported by healthy sentiment and market structure.

With smart money and retail sentiment aligned and short sellers increasingly on the defensive, Solana’s setup looks primed for a potential bullish breakout. However, traders should watch for confirmation via key technical levels before fully committing to the next leg higher.