- An ONDO whale sold 2.69 million tokens worth $2.13 million amid rising bearish pressure, signaling a strategic exit as the altcoin dropped nearly 11% in a week.

- On-chain data shows increased sell-offs by large holders, with technical indicators pointing to further downside unless buyers re-enter the market soon.

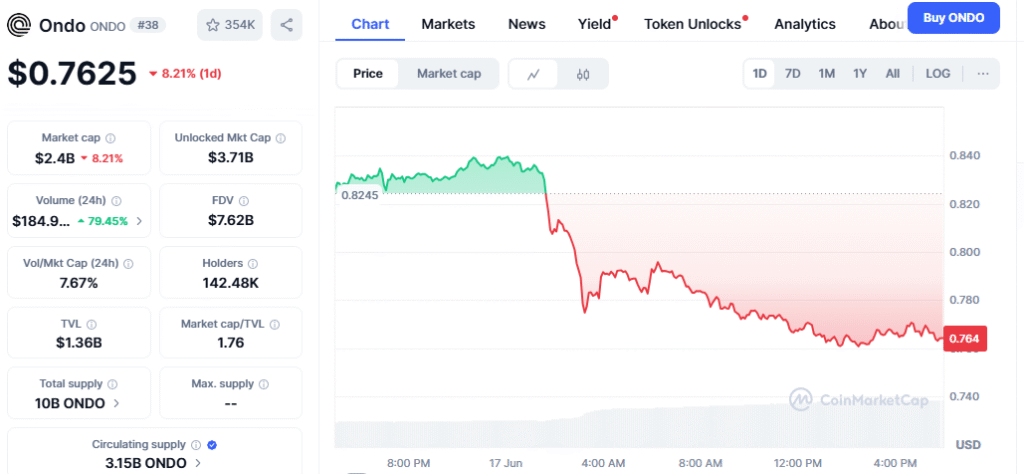

A major ONDO whale has exited the market, dumping 2.69 million tokens—worth approximately $2.13 million—amid intensifying bearish sentiment surrounding the altcoin. The move, reported by on-chain tracking platform Onchain Lens, comes after ONDO lost nearly 11% of its value in just one week, slipping from $0.92 to its current downward trajectory.

The whale had held the tokens for over two months, and despite the broader downtrend, managed to walk away with a modest $123,000 profit. Analysts suggest the timing of the sale indicates a calculated exit to prevent losses as the market continues to show signs of weakness.

Also read:Solana ETF Approval Odds Surge: Key Metrics and Institutional Moves Boost Case

This sale is just one part of a larger trend: data from IntoTheBlock reveals that large holders have offloaded 4.85 million ONDO tokens over the past 48 hours. Meanwhile, CryptoQuant’s Spot Average Order Size continues to reflect dominance by large transactions, confirming persistent whale involvement—albeit increasingly on the selling side.

Technical indicators paint a bleak picture. According to CoinGlass, ONDO’s spot netflow turned sharply positive, peaking at $762,000. While this may sound bullish at first glance, in reality, it signals mounting sell pressure—more tokens flowing into exchanges typically means more holders are preparing to liquidate.

The Moving Average Convergence Divergence (MACD) has stayed in bearish territory for five consecutive days following a negative crossover, indicating sustained downward momentum. The Relative Strength Index (RSI) has also fallen to 37, approaching oversold levels and reinforcing the dominance of sellers in the current market cycle.

With momentum clearly tilted to the downside, ONDO may now be testing support around $0.75—a critical level that served as a rebound point in recent weeks. If this floor fails to hold, further losses could drag the token down to $0.72. On the flip side, a reversal would require renewed buying activity, with bulls needing to reclaim and maintain levels above $0.80 to regain control.

As whale exits and on-chain metrics align with ongoing selling activity, ONDO’s near-term outlook remains cautious. Whether this marks a capitulation phase or a longer-term decline hinges on how the broader market—and particularly institutional players—respond in the coming days.