- Wealth Manager Matthew Snider warns that institutional accumulation, like Trident Digital’s $500M XRP reserve plan, could soon limit retail investors’ ability to buy XRP through dollar-cost averaging.

- As corporations increasingly scoop up XRP for long-term holdings, retail access may shrink, pushing prices higher and leaving smaller investors behind.

Retail XRP investors could soon find themselves squeezed out of the market, according to a stark warning from Matthew Snider, Chief Investment Officer at Digital Wealth Partners. His message follows a bombshell announcement from Nasdaq-listed Trident Digital, which revealed plans to create a $500 million XRP reserve—potentially altering the landscape for everyday investors.

Trident Digital’s move, aimed at establishing a substantial ripple treasury, involves raising funds via stock offerings and financial instruments, with implementation slated for later this year pending regulatory approval. The company is already in talks with institutional investors to finalize its XRP acquisition strategy, putting it alongside other corporate ripple holders like Webus International, Wellgistics Health, and VivoPower.

Also read: Ripple’s Legal Chief Sounds Alarm: 6 Crypto Scams Every XRP Holder Must Dodge Now

Snider emphasized that institutional accumulation at this scale could severely limit the supply of ripple on public exchanges. This, in turn, could undermine dollar-cost averaging (DCA) strategies used by retail investors to gradually build their positions. “Pretty soon, there won’t be any XRP left to DCA with,” Snider cautioned.

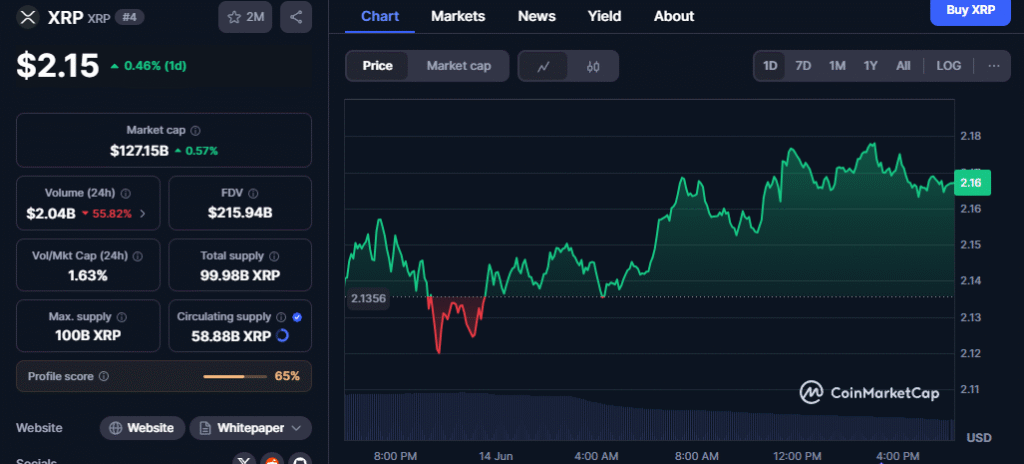

While such institutional buying might drive ripple price upward, it could also price out small-scale investors who rely on consistent, periodic purchases. Snider’s warning signals that time may be running out for those waiting on the sidelines.

Amid this institutional influx, debates continue over how much XRP is “enough” for personal financial goals. Edo Farina of Alpha Lions Academy recommends a baseline of 1,000 XRP, while King Vale pushes the figure to a hefty 50,000 ripple—worth over $100,000 at current prices. Critics, however, like community voice Xena, argue that such benchmarks are arbitrary and fail to reflect individual investment realities.

With corporate players increasingly targeting ripple for long-term reserves, the retail investment window could be narrowing fast. For those considering ripple, Snider’s message is clear: move quickly, or risk missing out entirely.