- GameStop’s stock plunged over 22% following news of a $1.75 billion convertible note offering, sparking speculation about another major Bitcoin investment.

- Despite the company’s growing crypto exposure, investors remain skeptical, with the stock erasing gains made since its initial Bitcoin adoption announcement.

GameStop Dives After Bold Crypto Move

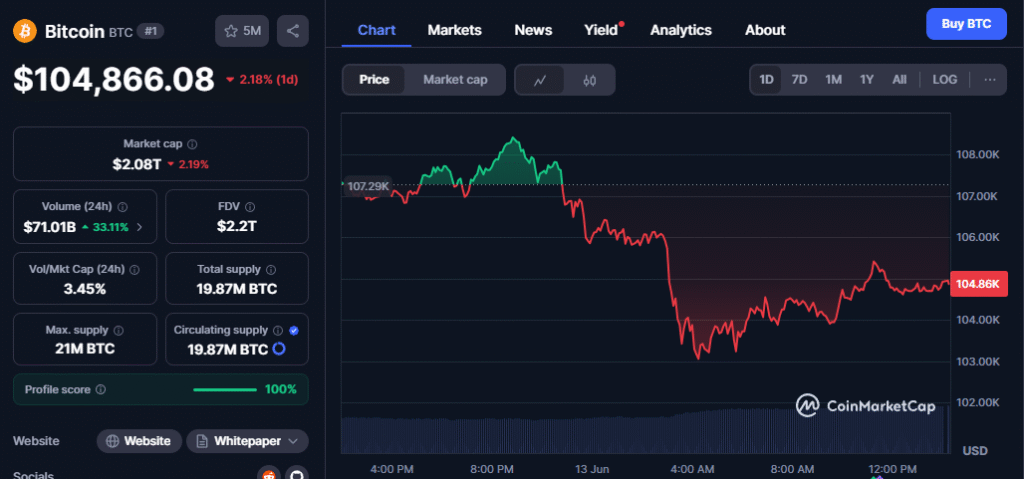

GameStop (GME) has shocked investors with a massive $1.75 billion convertible note offering, sparking fears and tanking its stock by over 22% in after-hours trading. The announcement, made on June 11th, hinted at further Bitcoin (BTC) investments—echoing its earlier $513 million purchase of 4,710 BTC in May—but failed to inspire confidence.

From a high of $28.55, GME shares plummeted to $22.14 following the news, reflecting mounting skepticism around the company’s crypto-forward strategy.

Also read: PEPE Crypto Price Prediction: 3 Reasons to Buy Now — And One Big Risk to Know

Bitcoin Isn’t a Silver Bullet

While GameStop hasn’t officially confirmed the $1.75B raise will go into Bitcoin, its recent history suggests a strong crypto lean. In late May, the company made headlines by becoming the 13th largest corporate BTC holder. However, instead of propelling GME higher, the crypto pivot seems to be weighing down the stock.

Investor sentiment remains wary. The initial crypto announcement in March saw brief gains, but every BTC-related move since has been followed by a selloff—highlighting that Bitcoin, in this case, isn’t a guaranteed market booster.

Social Media Reacts with “Insane!” Shock

Retail investors and traders didn’t hold back. One X (formerly Twitter) user said, “GME stock crashing AH on this news,” while another called a high-risk options trade “INSANE,” showcasing the community’s mixed emotions and speculative tension.

The broader takeaway? GameStop’s effort to mirror MicroStrategy’s Bitcoin strategy is met with far more doubt than enthusiasm.

Market Wants More Than Hype

GameStop’s foray into crypto shows that embracing Bitcoin isn’t enough to win over investors. The market demands clearer growth strategies, not just bold bets. As the stock erases all crypto-fueled gains since March, the company may need to rethink how it communicates—and executes—its financial future.