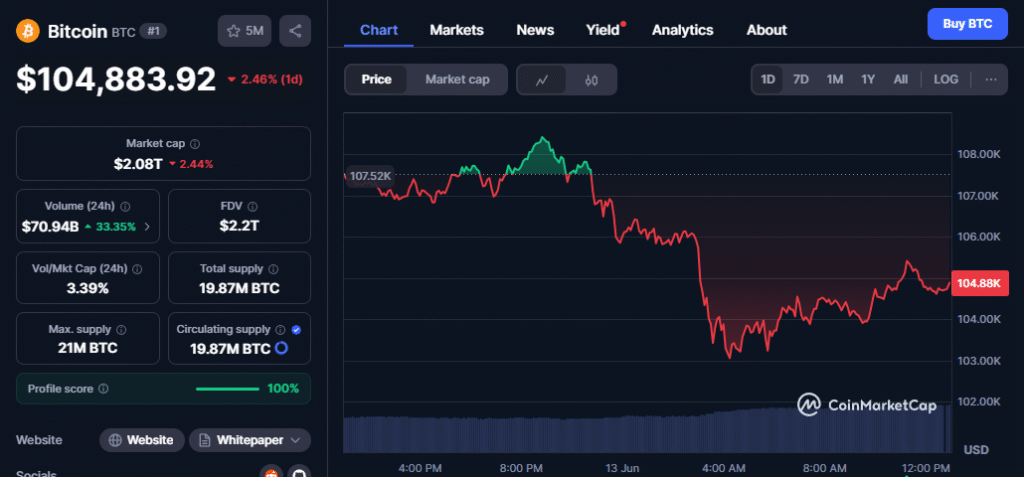

- Bitcoin is showing signs of a bullish setup as over 7,000 BTC have exited Binance and long-term holders have accumulated more than 600,000 BTC, reducing sell-side pressure.

- With short-term holders staying quiet and supply tightening, the stage may be set for a sustained and quieter bull run.

Bitcoin Sets the Stage for a Low-Drama Bull Run

Bitcoin [BTC] is quietly building momentum — not with explosive price swings, but with solid fundamentals that suggest a strong rally could be on the horizon. Unlike previous hype-driven surges, the current setup is defined by strategic long-term accumulation and a noticeable drop in sell-side pressure.

Recent data highlights a major shift: since June 6, more than 7,000 BTC have flowed out of Binance, one of the world’s largest exchanges. This exodus signals that investors are opting for self-custody, often a sign of reduced intent to sell in the short term. As centralized exchange balances shrink, so does available supply — creating conditions that historically precede significant upward moves.

Also read: Hyperliquid (HYPE) Price Pulls Back After ATH, But Bullish Momentum Signals Further Gains Ahead

Long-Term Holders Take the Lead

Adding fuel to the bullish narrative is the behavior of long-term holders (LTHs). For the first time since September 2024, LTH position change has surpassed the 600,000 BTC mark. This indicates a strong wave of confidence from seasoned investors — those who are in it for the long haul, not the daily price action.

At the same time, short-term holders (STHs), typically more reactive and prone to panic-selling, are sitting on the sidelines. Their absence contributes to a calmer, more stable price environment, reducing volatility and further strengthening the rally’s foundation.

The Quiet Before the Bull?

The current dynamic of reduced exchange supply, steady ETF inflows, and increased long-term accumulation paints a promising picture for Bitcoin’s next move. While it may not come with the fireworks of past bull markets, this quiet accumulation phase could spark a longer-lasting rally.