- PEPE is testing a crucial 50% Fibonacci support level, with large holders increasing their net flows by 1,645%, signaling potential bullish momentum.

- Despite recent long liquidations, strong whale activity and technical indicators suggest a possible rebound toward the $0.00001550 resistance.

Large Holders Fuel Hopes with Massive Accumulation Surge

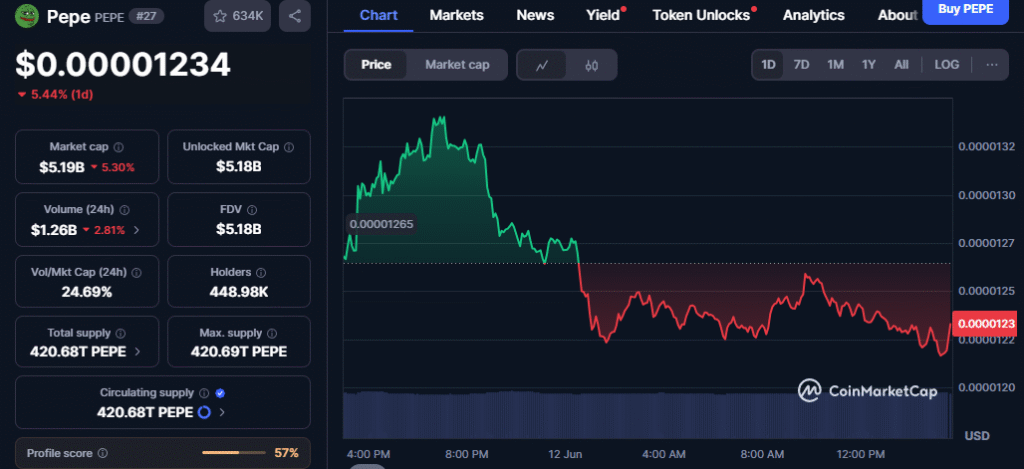

PEPE, the popular meme coin, is currently navigating a crucial moment as it retests its 50% Fibonacci support level near $0.0000122. After a sharp correction, concerns of a bearish turnaround have emerged. However, a striking 1,645% increase in net flows from large holders—investors owning more than 0.1% of the supply—signals renewed confidence in the token’s short-term prospects.

On June 11 alone, large holders netted a staggering 854.64 billion PEPE tokens, according to IntoTheBlock. This aggressive accumulation suggests that whales may be positioning for a potential bounce-back toward the next key resistance at $0.00001550.

Also read: Trump’s Crypto Reserve Names XRP – Why Holding Now Could Lead to Massive Gains

Price Analysis: Bulls Hold the Line at 50% Fibonacci

At the time of writing, PEPE is trading at $0.00001242, rebounding slightly from a 24-hour low of $0.0000121. Despite a 4.80% pullback earlier this week, the token remains above its critical 50% Fibonacci retracement level—a line that could determine its next direction.

Technical indicators remain cautiously optimistic. The recent golden cross and the tightening of the 100-day EMAs indicate the continuation of an uptrend. Moreover, the MACD is showing signs of a bullish crossover near the zero line, adding further weight to a possible rebound.

If the current support holds, PEPE may attempt to challenge the $0.00001550 resistance and, beyond that, $0.00001705. Conversely, a breakdown below $0.0000122 could open the doors to a retest of the 200-day EMA at $0.00001155.

Derivatives Market Sends Mixed Signals

The derivatives market paints a mixed but intriguing picture. Open interest in PEPE rose 0.30% to $577.44 million, reflecting ongoing trader engagement. However, long liquidations have doubled short liquidations in the past 24 hours—$1.97 million versus $920,000—hinting at over-leveraged bullish positions being flushed out.

Still, the funding rate remains positive at 0.0091%, showing that many traders are holding on to bullish bets despite short-term turbulence.

Bounce or Breakdown?

With whale accumulation on the rise and the price clinging to critical support, PEPE may yet have enough bullish fuel to mount a recovery. However, traders should remain cautious, as a failure to hold the 50% Fibonacci could tip the scales in favor of the bears.