- Shiba Inu’s burn rate surged over 5700% and retail activity spiked, but the price remained muted due to weak momentum and limited whale involvement.

- Despite this, rising exchange outflows and positive funding rates hint at growing long-term investor confidence and a potential breakout ahead.

Deflation Soars, But Price Stalls — What’s Going On?

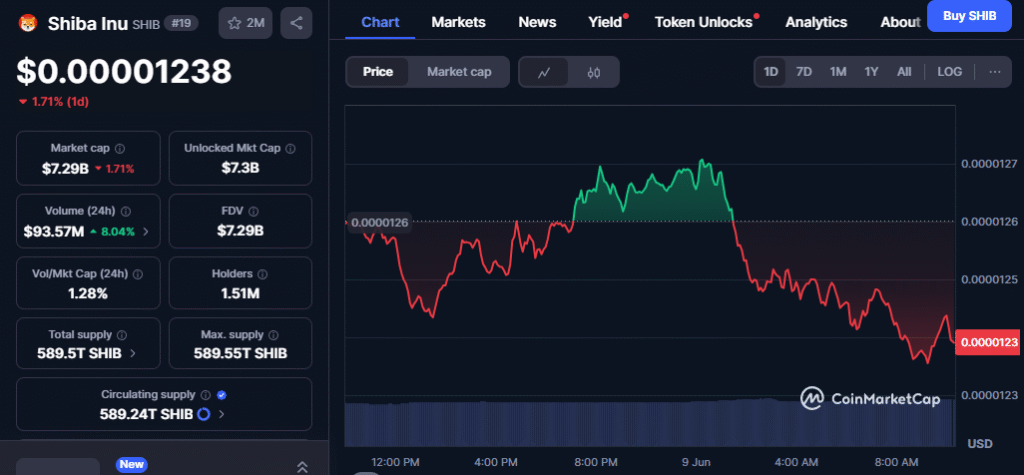

Shiba Inu (SHIB) is making noise behind the scenes — even if the price doesn’t show it just yet. Over the past 24 hours, SHIB’s token burn rate skyrocketed by a jaw-dropping 5762.9%, incinerating over 26 million tokens. Yet despite this massive deflationary push, the price dipped 1.82% to $0.00001259, leaving many investors puzzled.

This disconnect suggests that while deflation remains a core narrative for SHIB, it’s no longer enough to drive price action by itself — especially without broader market momentum.

Retail Steps In, Whales Step Back

On-chain data tells an interesting story: New Addresses surged by 19.83%, Active Addresses climbed 9.41%, and Zero Balance Addresses jumped 29.38%. These are signs of growing retail participation — but not all growth is equal.

Smaller transactions (under $1) exploded by 238.46%, while larger whale-sized transactions plunged — with $1K–$10K down 66.52% and $10K–$100K collapsing by 74.56%. In short, SHIB is now a retail-heavy battlefield, and without the whales, major price surges remain elusive.

Also read: Trump vs. Musk Sparks Crypto Chaos: Bitcoin Dips While FloppyPepe (FPPE) Gains Investor Momentum

Holding the Line at Demand Zone

Technically, SHIB is still consolidating within a key demand range: $0.00001028 to $0.00001196. This zone has historically attracted buyers, but the price is still trapped below a descending trendline, which keeps the bigger picture bearish.

The Relative Strength Index (RSI) at 41 suggests momentum is weak, but not oversold — meaning there could still be room to drop before a meaningful reversal kicks in.

Exchange Outflows Hint at Holder Confidence

Interestingly, SHIB’s exchange dynamics signal a shift in sentiment. Outflows surged 92.01%, nearly doubling inflows — a bullish sign that more holders are opting for self-custody over selling. This behavior typically indicates long-term conviction and less immediate sell pressure.

Bulls Show Signs of Life – But Not Yet a Charge

SHIB’s funding rate turned slightly positive (0.0048%), reflecting early bullish interest in derivatives markets. Meanwhile, data shows a key liquidity cluster between $0.0000132 and $0.0000133, where a breakout could trigger short liquidations and fuel upside momentum.

Still, unless SHIB can break this resistance and attract stronger whale support, its rally may remain in standby mode.

SHIB’s surging burns, retail traction, and rising outflows show early signs of a potential trend shift. But without big money and a technical breakout, any rally may be delayed — not denied. For now, SHIB holders seem ready to play the long game.