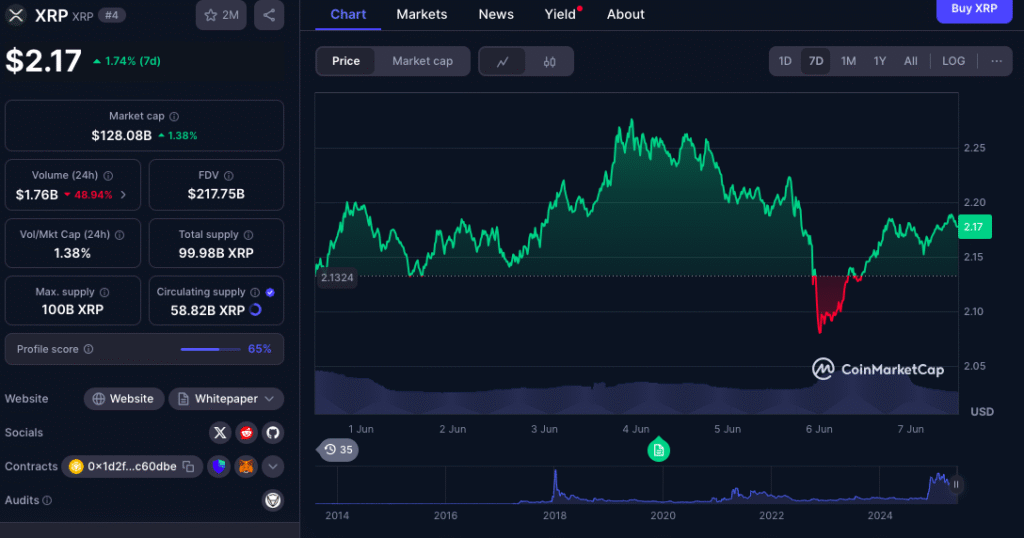

- Crypto commentator RemiReliefX has walked back his bold $1,200 XRP price prediction, only to cite Elon Musk’s AI, Grok, suggesting an even higher $1,700 target.

- Despite the sarcasm, his claims highlight XRP’s growing institutional relevance, potential ISO 20022 integration, and Ripple’s possible transformation into a major banking entity.

A once-bold XRP price forecast is back in the spotlight as crypto commentator RemiReliefX publicly reconsiders his earlier $1,200 prediction—only to cite Elon Musk’s AI, Grok, as support for a more ambitious $1,700 estimate. Despite the sarcastic tone of his June 4 post, RemiReliefX doubled down on the core thesis: that Ripple’s technology and XRP’s institutional utility may be setting the stage for unprecedented valuation.

XRP’s Institutional Role: From SWIFT to Central Banks

RemiReliefX’s recent posts highlight content he first shared in late 2024, including claims that XRP and Stellar’s XLM were selected by the International Monetary Fund (IMF) and the Bank for International Settlements (BIS) for integration into a new global financial system. He suggested that if XRP were to capture just 10% of the SWIFT payments network, the token could realistically reach $1,000.

Further, he pointed to possible XRP use by Visa, Mastercard, hedge funds, and even the U.S. Treasury as signs of future mass adoption. This utility-based valuation model relies on XRP’s real-world function—beyond speculation—and its alignment with regulatory frameworks.

Also read: Bitcoin Falls Below $103K as Dogecoin, XRP, and Solana Lead Crypto Market Decline

Ripple’s Banking Ambitions and ISO 20022 Momentum

Remi’s latest assertions were backed by user @SMQKEDQG, who shared ISO 20022 documentation referencing Ripple’s Interledger Protocol. ISO 20022 is a major global financial messaging standard, and its apparent validation of Ripple signals possible integration with SWIFT and other banking institutions.

On May 4, Remi responded to a user suggesting Ripple could become a licensed bank. He reinforced this idea, stating Ripple could evolve into “the biggest and best bank…The Fed/Treasury.” The sentiment positions Ripple not only as a blockchain innovator but also as a potential anchor in the traditional financial system.

Crypto Sarcasm Meets Institutional Signals

While RemiReliefX poked fun at his initial price prediction, the substance of his argument remains rooted in technical and institutional progress. Referring to his supporting evidence as “Remi Receipts,” he emphasized that XRP’s role in financial infrastructure could justify long-term bullish projections.

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.