- Nearly $3.7 billion in Bitcoin and Ethereum options are expiring today, with both assets trading below their max pain levels, indicating potential short-term volatility.

- The dominance of call options suggests bullish sentiment, but losses may hit both bulls and bears as markets react.

Bitcoin Options Expiry Signals Potential for Price Turbulence

The crypto market is poised for increased volatility as $3.1 billion worth of Bitcoin options contracts are set to expire on June 6. According to Deribit data, 30,750 contracts are reaching maturity, far fewer than last week’s 92,459 contracts, but still significant in terms of market impact. The current put-to-call ratio for these options stands at 0.7, indicating that call options are more prevalent—a sign of lingering bullish sentiment among traders.

Despite this, Bitcoin is trading below its maximum pain point of $105,000, at around $102,769. The “max pain” level represents the price at which option buyers experience the most financial loss, and prices tend to gravitate toward it as expiry approaches. This positioning suggests that both bulls and bears could suffer losses, potentially triggering rapid market movements.

Also read: How Much Will 2,000 XRP Be Worth by 2025? Analyst Predicts Massive Bull Run Potential

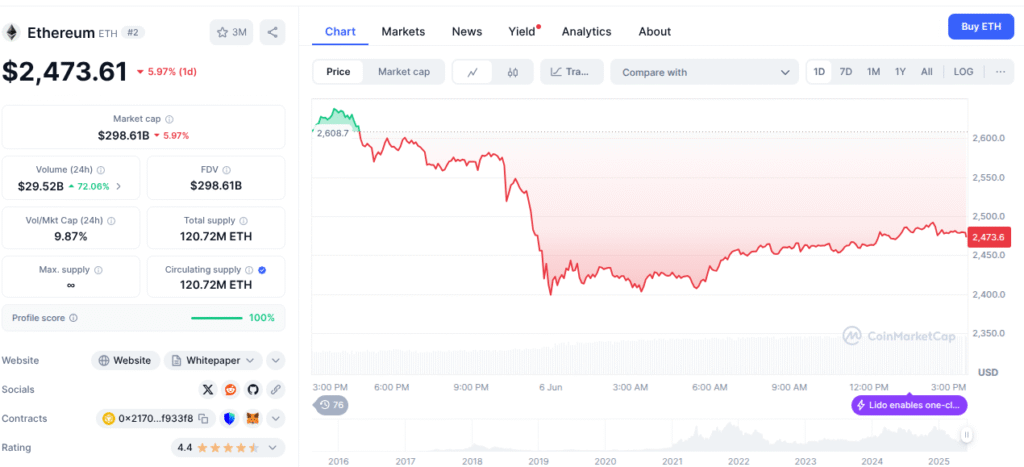

Ethereum Contracts Also Below Max Pain Level

Ethereum is facing a similar scenario, with $588 million worth of options expiring today. A total of 240,054 contracts are set to lapse, with a put-to-call ratio of 0.63—again signaling more calls than puts. However, like Bitcoin, Ethereum is currently trading below its max pain point of $2,575, sitting at approximately $2,456 at the time of writing.

This underlines a cautious sentiment in the Ethereum market, as traders await post-expiry price action. The convergence of call-heavy positioning and prices below the critical pain threshold may intensify short-term volatility.

Market Reaction Could Drive Short-Term Price Swings

As both Bitcoin and Ethereum options expire, traders are closely watching for abrupt price shifts. The dominance of call options across both assets suggests that many investors were betting on upward momentum. However, with both coins trading below their respective pain levels, the expirations could result in sudden market corrections—or new rallies—depending on liquidity flows and spot market sentiment.

With nearly $4 billion on the line, today’s expiry event could set the tone for the coming days in crypto markets, as investors recalibrate strategies in response to shifting technical and psychological levels.