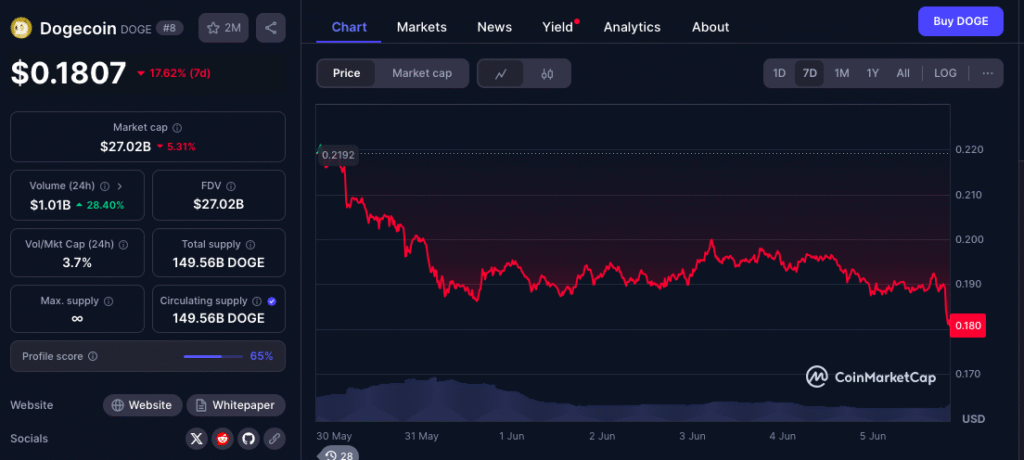

- Dogecoin is nearing its critical $0.18 support level amid a broader meme coin market decline, with technical indicators and rising long liquidations pointing to a potential drop toward $0.14.

- Weakening momentum and reduced trader participation suggest further downside risks for DOGE in the short term.

Dogecoin Slips Toward Key $0.18 Support

Dogecoin (DOGE) is teetering on a crucial support level at $0.18 amid a broader sell-off in the meme coin sector. The entire meme coin market capitalization has dipped below $60 billion, reflecting increased bearish sentiment across the board. DOGE has lost nearly 4% in the past 24 hours, raising concerns of a deeper correction toward the $0.14 level.

Technically, Dogecoin’s failure to break past the $0.25 resistance zone triggered a significant pullback. The price has fallen below the 200-day exponential moving average (EMA) and the 23.60% Fibonacci retracement level near $0.21—key indicators of weakening bullish momentum. If DOGE decisively breaks below $0.18, the projected drop toward $0.14 could confirm a bearish reversal.

Also read: Ripple Unlocks $2.2B in XRP From Escrow for June 2025, Adding 330M Tokens to Circulation Amid Whale Transfers to Coinbase

Also read: Ripple Unlocks $2.2B in XRP From Escrow for June 2025, Adding 330M Tokens to Circulation Amid Whale Transfers to Coinbase

Technical Indicators Suggest Bearish Continuation

Chart analysis shows that Dogecoin’s daily Relative Strength Index (RSI) has slipped below the midpoint, signaling a momentum shift to the downside. This invalidates the previously forming cup-and-handle pattern, which had a neckline at $0.25.

Dogecoin at Risk of Crashing to $0.14 as Meme Coin Market WeakensBy Albert Brown | June 5, 2025’s drop of 2.6% on Wednesday underscores growing bearish pressure. Should the $0.18 level fail to hold, the next reliable support zone lies at $0.14—a level last seen in early 2024. Resistance, meanwhile, is likely to mount around $0.21, making any upward recovery increasingly difficult without a major shift in market dynamics.

Long Liquidations and Falling Open Interest Amplify Pressure

The derivatives market paints a grim picture for Dogecoin bulls. Over the past 24 hours, DOGE long liquidations surged to $5.19 million, while short liquidations stood at just $416,000. The sharp imbalance indicates a mass exodus of bullish positions, further contributing to downside pressure.

Moreover, open interest in Dogecoin has dropped by 1.42% to $2.07 billion, suggesting reduced trader engagement. Despite a slight recovery in the OI-weighted funding rate—from 0.0020% to 0.0080%—short-term optimism remains fragile.