- Classover, a Nasdaq-listed EdTech firm, is set to raise $500 million to build a decentralized learning platform on the Solana blockchain, signaling a major shift toward real-world utility in Web3.

- This institutional move reflects growing confidence in Solana’s infrastructure, as long-term SOL holdings and recent upgrades point to sustained adoption beyond speculation.

Classover Bets Big on Solana’s Infrastructure

Nasdaq-listed EdTech firm Classover (KIDZ) has announced plans to raise $500 million in a bold move to develop decentralized education platforms on Solana’s high-performance blockchain. This isn’t merely about asset accumulation. Partnering with SOL Strategies, Classover’s initiative marks a deeper institutional commitment—one focused on real-world utility, not speculation.

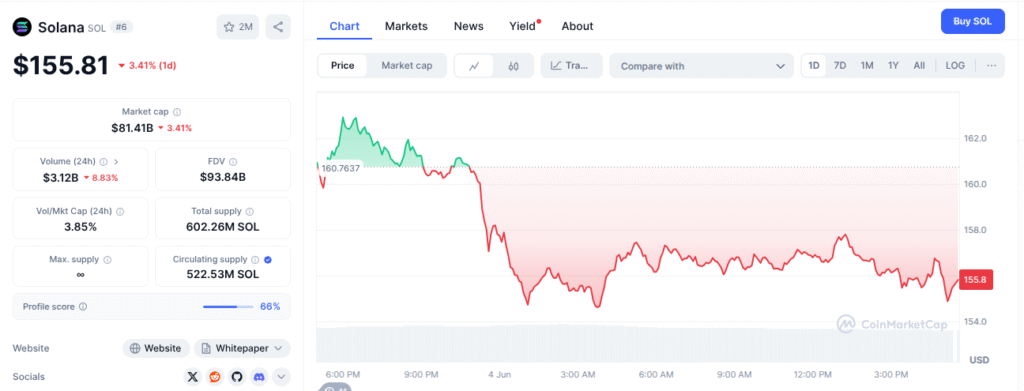

The news sent Classover’s stock soaring nearly 40%, hitting a two-week high of $4.82, while SOL reclaimed the $160 mark, signaling renewed investor confidence. This move follows a growing trend where public companies are choosing to build on blockchain, not just trade it—indicating a clear shift toward Web3 utility.

Also read: Ethena (ENA) Price Eyes Recovery After $4.41M Whale Inflow — Can It Break Resistance?

Solana Attracts Builders, Not Just Buyers

Unlike many Layer 1s that rely on hype-driven narratives, Solana’s recent institutional traction appears grounded in long-term strategy. Within days, two public companies made major investments in the ecosystem. What sets Solana apart is that these aren’t typical “buy-and-hold” plays—firms are actually using the blockchain to create products.

Classover’s $500M initiative aims to launch a decentralized learning platform, leveraging Solana’s speed, scalability, and low transaction costs. This development reflects a broader trend: companies want reliable, efficient networks to build on—not just speculative price pumps.

Long-Term Holders Reflect Growing Confidence

Backing up this momentum is a significant shift in holding patterns. According to on-chain data, wallets holding SOL for 1–2 years now account for 21% of the supply, nearly double from a year ago. This uptick in long-term holdings suggests that early speculators are evolving into dedicated believers in Solana’s future.

Fueling this confidence is Solana’s recent ‘Alpenglow’ upgrade, which improved network efficiency and readiness for large-scale applications. Combined with the influx of institutional investment, these developments point to a foundational shift—where blockchain adoption is led by builders, not just traders.

As more firms like Classover choose Solana as their go-to platform, the blockchain’s narrative continues to evolve—from a speculative asset to a serious infrastructure for the next generation of decentralized applications.

Classover’s $500 Million Commitment Puts Solana at the Center of Web3 Education

In a major boost for Solana (SOL), Nasdaq-listed EdTech firm Classover (KIDZ) has announced plans to raise $500 million to build a decentralized learning platform on the Solana blockchain. The partnership with SOL Strategies is not just about acquiring digital assets—it represents a long-term investment in Solana’s scalable infrastructure for real-world use cases.

Following the announcement, Classover’s stock price surged nearly 40%, reaching $4.82, while SOL climbed back above $160, reflecting renewed investor interest. This signals a broader institutional trend: public companies are no longer just buying crypto—they’re building with it.

Solana Institutional Adoption Driven by Real-World Use Cases

Solana’s recent string of institutional partnerships is reshaping its reputation from a speculative asset to a utility-first blockchain. With Layer 1 blockchains fiercely competing for relevance, Solana stands out by attracting companies like Classover that are leveraging its fast, low-cost network for decentralized applications.

Unlike typical market plays, Classover’s initiative is centered around delivering decentralized education platforms, a clear indicator of how Web3 technology is transitioning into practical sectors. This development reflects Solana’s ability to support scalable, high-performance applications in real-world environments—especially as blockchain adoption in education gains momentum.

Long-Term SOL Holders Signal Confidence in Blockchain Fundamentals

Backing these institutional moves is growing confidence in Solana’s long-term viability. According to on-chain data, wallets holding SOL for 1–2 years now represent 21% of the circulating supply, nearly doubling from last year’s 10–11%. This increase in long-term holders suggests a shift away from short-term speculation toward sustained belief in the network’s future.

Solana’s recent ‘Alpenglow’ upgrade has also played a role in reinforcing its appeal, optimizing performance and preparing the network for enterprise-level adoption. As Solana continues to attract major corporate players like Classover, its transition from hype to infrastructure becomes clearer.