- BlackRock and Fidelity have shifted $180 million from Bitcoin into Ethereum, signaling strong institutional confidence ahead of potential ETH staking approval.

- Growing bullish sentiment and strategic whale activity suggest Ethereum is becoming the top choice for both big investors and retail traders.

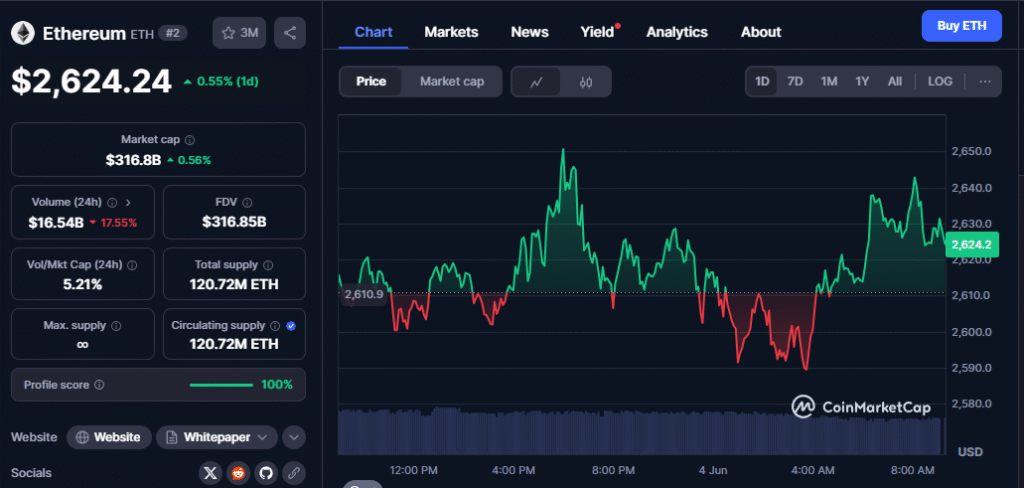

Ethereum [ETH] is entering a bold new phase, and the smart money knows it. In a striking shift that’s turning heads across the crypto world, institutional giants BlackRock and Fidelity have rotated a massive $180 million out of Bitcoin (BTC) and directly into Ethereum — a signal that something big is on the horizon.

Why the switch? Speculation is mounting that ETH staking approval for ETFs could be imminent, unlocking a new era of institutional yield and confidence. This isn’t just a portfolio shuffle — it’s a strategic pivot toward what many now view as the future of decentralized finance.

Also read: Bitcoin, Ethereum, and Ripple Price Prediction: BTC, ETH, and XRP Target Breakout as Crypto Recovery Builds Momentum

The $180M Flip: Bitcoin Out, Ethereum In

On June 2nd, BlackRock and Fidelity made headlines by trimming their BTC holdings and shifting capital into Ethereum. According to ETF net inflow data, nearly 30,000 ETH (around $78 million) was added to their books, hinting at strong conviction in Ethereum’s evolving role in the market.

This isn’t just about price — it’s about positioning. With ETH staking potentially getting the green light, institutions are making their move before the gates open wide.

Social Buzz and Whale Confidence

According to Santiment, social sentiment is heavily skewed in Ethereum’s favor — with three bullish posts for every one bearish. Bitcoin, meanwhile, sees a more cautious 1.3:1 ratio. The crypto community is clearly leaning bullish on ETH, and whales are making notable moves despite temporary losses.

One whale, who accumulated over 13,478 ETH during late 2024 and early 2025, has begun offloading chunks to Binance — but still holds thousands of ETH. Their strategic sell-off, despite a $15.66 million unrealized loss, suggests repositioning, not panic.

The Takeaway

Ethereum is no longer just a smart contract platform — it’s shaping up to be the institutional favorite of 2025. With staking on the verge of approval, whales repositioning, and bullish sentiment rising, Ethereum’s “big moment” may be just getting started.

As capital flows shift and institutions go all-in on ETH, one thing’s clear: Ethereum is no longer the underdog — it’s the main event.