- Dogwifhat, SPX6900, and Pepe Coin show strong bullish patterns, signaling potential price gains driven by favorable technical indicators.

- In contrast, Bonk is losing momentum, with bearish signals suggesting a possible decline toward $0.000015.

Dogwifhat Forms Bullish Cup-and-Handle Pattern

WIF has already crossed above both the 50-day and 100-day Exponential Moving Averages (EMA), signaling growing bullish momentum. Momentum indicators such as the Relative Strength Index (RSI) and Money Flow Index (MFI) are also trending higher. If the pattern plays out, WIF could surge to around $2.38, which sits just below the 50% Fibonacci Retracement level.

SPX6900 Surges Within Ascending Channel

SPX6900 (SPX) has emerged as one of the top-performing meme tokens this year, with a 360% gain since March. Its price has formed a well-defined ascending channel marked by consistent higher highs and higher lows — a structure that often suggests a sustained bullish trend.

Currently trading at $1.1587, SPX remains comfortably above both the 50-period and 100-period moving averages. Technical oscillators continue to point higher, and the token is nearing the 61.8% Fibonacci level. If upward momentum holds, SPX could target $1.5 in the short term. However, a breakdown below $1 would negate this bullish scenario.

Also read: Bitcoin Price Breakdown: Analyst Predicts Over 10% Crash as Bearish Trend Confirmed

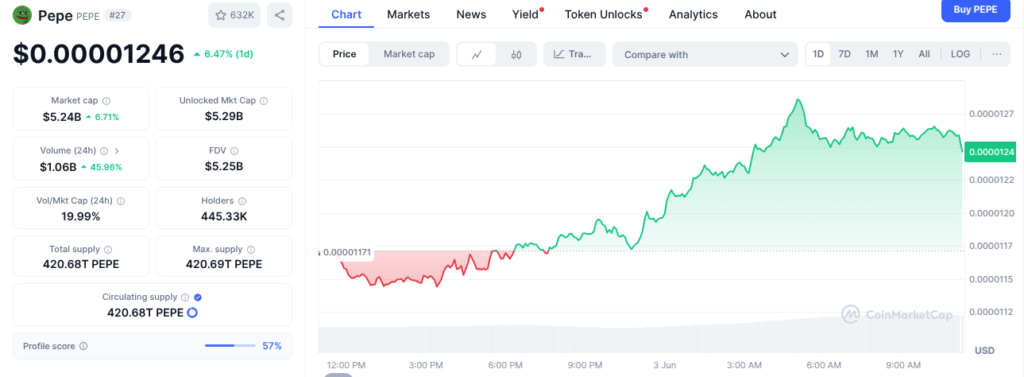

Pepe Coin’s Golden Cross Hints at More Gains

Pepe Coin (PEPE) has been riding a wave of bullish sentiment, having recently printed a golden cross — where the 50-day EMA crosses above the 200-day EMA. This pattern is widely viewed as a long-term bullish indicator.

After bottoming at $0.000005298 in March, PEPE reached $0.00001628 in late May, its highest level since January. With RSI rising and price action targeting the 38.2% Fibonacci level, the next major resistance sits at $0.00001628 — 30% above current levels. A drop below the 200-day EMA at $0.000011 would challenge the bullish thesis.

BONK Faces Bearish Outlook Despite Recent Rebound

Unlike its peers, Bonk (BONK) is showing signs of weakness. After forming a bullish double-bottom between March and April, the meme coin rallied but has since slipped below the 50-day and 100-day EMAs. The current rebound appears to be a dead cat bounce, with the Average Directional Index (ADX) indicating declining trend strength.

If bearish momentum continues, BONK could fall to $0.000015 — a significant drop from its recent highs.