- Institutional investment in crypto ETPs has surged to a record $10.8 billion in 2024, reflecting strong confidence in Bitcoin and Ethereum despite mounting macroeconomic uncertainty.

- However, the market now faces a key test as $3.3 billion worth of token unlocks in June could introduce short-term volatility and pressure token prices.

Institutional interest in crypto is surging to record highs in 2025, with global crypto exchange-traded products (ETPs) amassing $10.8 billion in inflows year-to-date. But even as traditional finance deepens its crypto footprint, the market braces for a fresh test: over $3.3 billion in token unlocks set to flood the market in June.

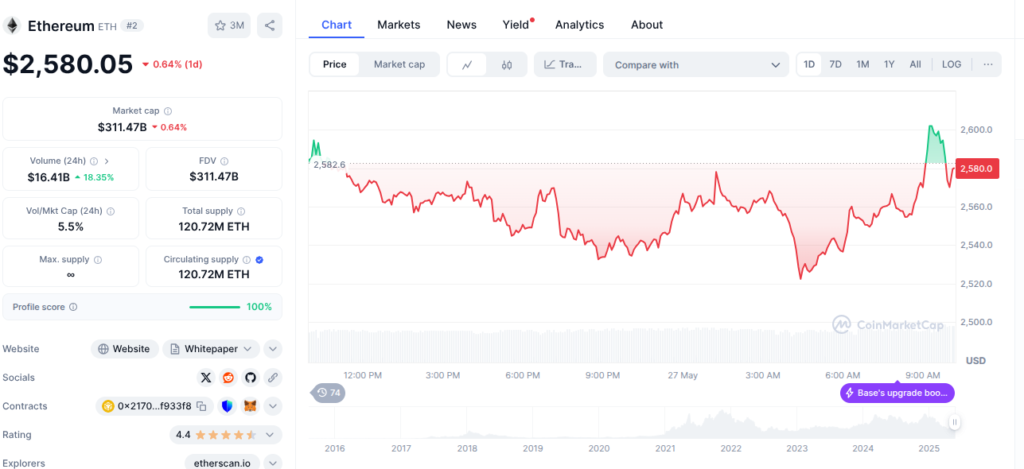

Led primarily by Bitcoin and Ethereum products, the latest wave of institutional investment signals renewed confidence in the digital asset class. According to CoinShares, Bitcoin products alone drew $2.9 billion in net inflows for the week ending May 24, pushing total crypto ETP assets under management to a brief high of $187.5 billion. Ethereum ETPs weren’t far behind, recording $326 million in inflows as enthusiasm builds post-Pectra upgrade and amid U.S. spot ETF speculation.

Also read: Bitcoin Targets $115K as 7B PEPE Long Ignites Market Momentum, Dogecoin (DOGE) Rally on the Horizon

However, not all tokens are enjoying investor favor. XRP-based ETPs saw a historic $37.2 million in outflows, ending an 80-week inflow streak. Analysts point to the token’s recent price underperformance as a potential cause for concern, despite growing ETF optimism and rising open interest in XRP futures.

Yet as capital continues to flow into structured crypto products, the broader market faces a looming supply shock. According to Tokenomist, $3.3 billion worth of crypto tokens are scheduled for release in June due to vesting expirations—down from May’s $4.9 billion but still significant.

Among the most anticipated is a $193 million unlock from Metars Genesis (MRS) on June 21, tied to a new AI partnership. Sui (SUI), Aptos (APT), and LayerZero (ZRO) are also set for substantial releases, with many tokens destined for early investors and treasury reserves—raising concerns about potential sell-offs and dilution.

While the unlock wave may introduce short-term volatility, many analysts see it as part of a maturing market. Institutional demand is holding strong, and with Bitcoin above $110,000 and Ethereum gaining post-upgrade momentum, the question now is whether crypto’s evolving investor base can absorb the influx.

As tokenomics transparency and supply dynamics take center stage, June will likely reveal whether crypto markets are truly resilient—or still vulnerable to the shocks of a growing ecosystem.