- Kraken has launched tokenized versions of Apple, Tesla, and Nvidia stocks on the Solana blockchain, enabling 24/7 global trading through its new xStocks platform.

- This move offers fractional investing, instant settlement, and broader access to U.S. equities, especially for investors outside the U.S., with full regulatory backing

Global investors gain round-the-clock access to U.S. equities through Kraken’s xStocks initiative, powered by Solana.

In a move poised to redefine traditional stock trading, Kraken has announced the launch of tokenized versions of top U.S. stocks—Apple, Tesla, Nvidia—and the SPDR S&P 500 ETF. Dubbed xStocks, the initiative runs on the Solana blockchain, enabling 24/7 global trading with instant settlement and lower costs.

Breaking Wall Street’s Time Barriers

Unlike traditional markets that shut down on weekends and holidays, Kraken’s xStocks operate round the clock. Each digital token represents a 1:1-backed share of its underlying asset, held in custody by Backed Finance, ensuring full transparency and redemption capability.

This 24/7 accessibility gives global investors—particularly those in Asia, Latin America, Africa, and Europe—unprecedented access to the U.S. stock market without high brokerage fees or restricted trading hours.

“We’re bringing Wall Street access to the blockchain,” Kraken said in a statement, highlighting how Solana’s high throughput and low fees made it the ideal platform for this rollout.

Also read: XRP Price Targets $3 as EURØP and USDB Stablecoins Launch on XRP Ledger, Boosting Liquidity and Global Use Cases

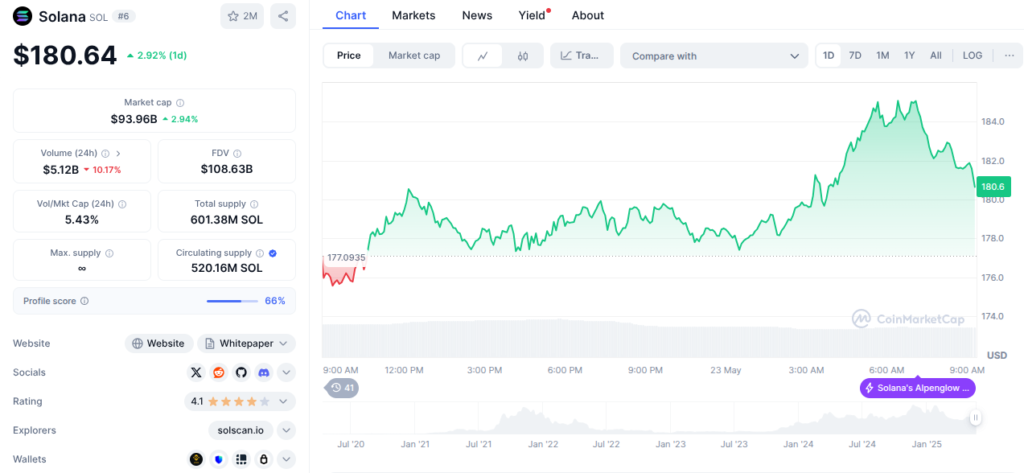

Why Solana? Fast, Cheap, Scalable

Kraken’s decision to use Solana reflects its focus on scalability and efficiency. The blockchain’s low transaction costs and lightning-fast speeds allow seamless trades of tokenized stocks, democratizing access and making fractional investing viable for retail users.

Kraken also hinted that xStocks could eventually become multi-chain, offering broader integration across blockchain ecosystems in the future.

Regulatory Clarity Sets Kraken Apart

Unlike Binance’s short-lived tokenized stock program in 2021, Kraken is prioritizing regulatory compliance and transparency. The exchange already began offering tokenized stocks to U.S. customers in April and is actively pursuing expansion in the UK and Australia.

This regulatory-first approach may give Kraken a long-term edge in the race to tokenize traditional assets, especially as institutional interest in digital securities grows.