Crypto Market Liquidations Soar $1.09 Bln, Bitcoin and Altcoins Crash on Trump Tariffs

As Trump tariffs on Mexico and Canada go into effect on March 4, the crypto market crashed, triggering more than $1.09 billion in liquidations in the last 24 hours. While Bitcoin is down over 10% in the last 24 hours, top altcoins like Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) are all down by 15-25% in the last 24 hours. This shows that the hype of Trump’s US strategic reserves remains short-lived as investors brace for the reality.

Crypto Market Crash Sees Surge in Liquidations

Today’s crypto market crash has been one of the fastest falls on record, with more than $460 billion being eroded from the crypto market cap in 24 hours. As per the Coinglass data, the overall crypto liquidations have soared to more than $1.09 billion with BTC alone contributing more than $400 million.

The cryptocurrency market has experienced its most dramatic selloff of 2025, shedding a staggering $460 billion in just 24 hours. This translates to an average loss of approximately $19.1 billion per hour over the past day, noted The Kobeissi Letter.

Source: The Kobeissi Letter

Bitcoin Price Heading to $70,000 Again?

Following the announcement of strategic US crypto reserves on Sunday by President Donald Trump, Bitcoin price made a brief rally to $93,000 facing rejection once again as Trump tariffs kicked in. Market analysts believe that despite Trump’s executive order on crypto reserves, it would still need Congressional approval to pass through.

As of press time, the BTC price is down 10.23% trading at $83,500 levels with daily trading volumes jumping by 15% to $77 billion. Crypto market analysts predict that it won’t be surprising if Bitcoin crashes in the range of $70,000-$75,000 before resuming a full-blown uptrend.

Former BitMEX CEO Arthur Hayes has expressed confidence in the ongoing bull cycle for Bitcoin, however, suggested that BTC’s worst-case bottom would align with the previous cycle’s all-time high of $70,000.

Popular crypto analyst KALEO also reiterated the stand saying: “after the type of wick we saw across the board for BTC and alts earlier (major move up + full retrace) it shouldn’t be surprising if another leg down to the mid 70s for Bitcoin”.

What’s Next for Altcoins?

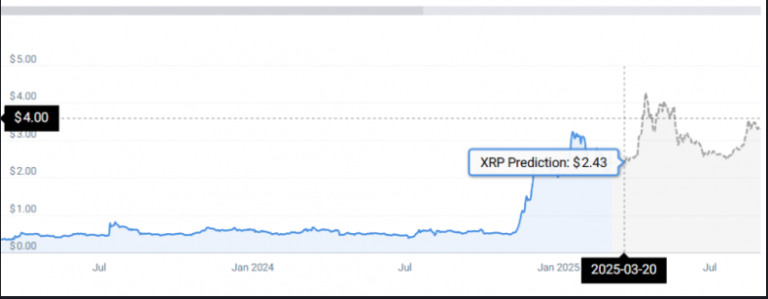

Throughout February, altcoins have delivered a very poor performance with Ethereum (ETH), Solana (SOL), XRP, Cardano (ADA), all facing huge selling pressure and correcting 25% over the past month.

Over the last 24 hours, the altcoins crash has been even severe with Ethereum price tanking to $2,000 and is on track to register its worst performing Q1 in history. Crypto market analysts are requesting investors to stay patient and not sell in panic. Popular analyst Michael van de Poppe noted:

“Most of the altcoins are giving back their gains against Bitcoin today. Why? People want to get out, that’s why they sell on every bump upwards and that’s why things will take time. Just be patient”.

Currently, the market sentiment for an alt season is at the rock bottom against the high expectations at the beginning of the year.

The post Crypto Market Liquidations Soar $1.09 Bln, Bitcoin and Altcoins Crash on Trump Tariffs appeared first on CoinGape.