Ethereum in July: Price Dips, L2s Boom, and NFT Market Slumps

More from the Author Sean Williams

In July 2024, Ethereum faced significant price volatility, with sharp declines and rebounds, while Layer 2 solutions saw remarkable growth and the NFT market struggled.

Despite these challenges, Ethereum’s expanding Layer 2 ecosystem and ongoing innovations in DeFi offer potential for future stability and growth.

Navigating a Month of Extreme Volatility

July 2024 proved to be a rollercoaster for Ethereum (ETH), marked by sharp price swings, booming Layer 2 (L2) activity, and a struggling NFT market. Despite significant innovations in decentralized finance (DeFi) and an expanding L2 ecosystem, Ethereum grappled with volatility and declining network metrics. This article explores the key events of July and their implications for Ethereum’s future.

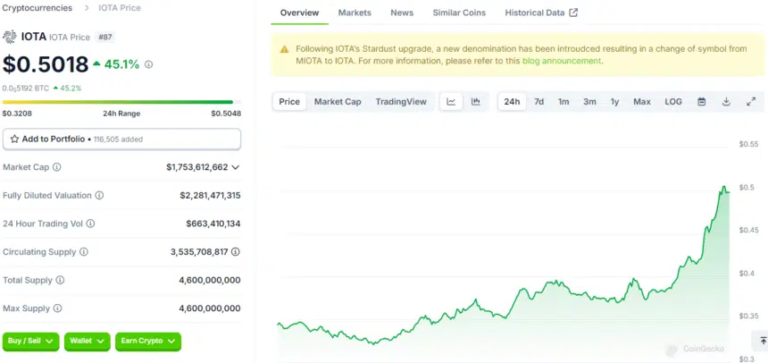

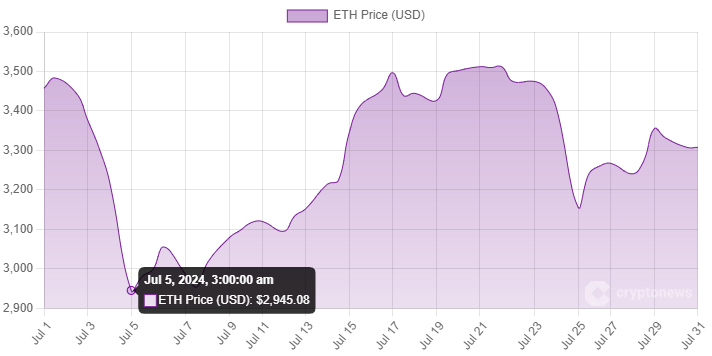

Price Fluctuations and ETF Impact

Ethereum’s price journey in July was turbulent. Beginning the month with a significant 16.5% drop from $3,440 to $2,857, ETH rebounded with a 19% gain, peaking at $3,536 by July 21. However, the price faced another setback, dropping 10% to $3,170 on July 25, coinciding with the launch of several spot Ether ETFs on the New York Stock Exchange. This “sell-the-news” effect, where investors sell assets following anticipated positive events, led to a final monthly close at $3,321. A potential catalyst for recovery was Donald Trump’s positive stance on crypto, announced at the Bitcoin 2024 conference.

Decline in Network Activity and Transaction Fees

Ethereum’s network activity showed signs of weakness. Weekly active addresses fell by 22.8%, and the number of new addresses decreased by 14% compared to June. Daily transaction fees plummeted by 67% from Q1 2024 peaks, averaging below $3 million in July. Despite a 13% increase in total value locked (TVL) to $59.6 billion, Ethereum’s dominance faced challenges from competitors like Solana (SOL), The Open Network (TON), and Binance Chain (BNB), which surpassed Ethereum in key metrics.

Layer 2 Solutions Surge

Amidst these challenges, Ethereum’s Layer 2 solutions experienced explosive growth. Networks such as Base, Arbitrum, and Linea saw a 127% increase in average daily active addresses in the first half of 2024. The TVL in L2 solutions surged 245% in July, reaching 44.5 million ETH. This expansion highlights Layer 2’s role in scaling Ethereum and reducing transaction fees, with significant improvements in efficiency and user experience.

NFT Market Decline

Ethereum’s NFT market also faced a tough July. NFT trading volumes dropped by 49%, with Blur capturing 60% of the market share. Notably, the once-popular Bored Ape Yacht Club and CryptoPunks collections saw declines in sales. Despite these setbacks, Ethereum remained the top network for NFT sales, though the sector’s overall growth has stalled.

Challenges and Opportunities

Ethereum’s July was a blend of setbacks and advancements. Price crashes, declining network activity, and NFT market struggles underscore the challenges facing the network. However, the growth of Layer 2 solutions and innovations in DeFi offer hope for future stability and growth. To achieve its price targets and overcome competition, Ethereum must address scalability issues and continue leveraging its strengths in smart contracts and decentralized applications. The road ahead involves navigating these complexities while capitalizing on emerging opportunities to maintain its position as a leading blockchain platform.

The post Ethereum in July: Price Dips, L2s Boom, and NFT Market Slumps appeared first on Crypto News Focus.