3 Reasons Why Bitcoin (BTC) Crashed Going into The Weekend

- Investors were served a huge blow going into the weekend as Bitcoin (BTC) crashed by more than 5% to end Friday trading at $21,000.

- With the Ethereum Merge spreading optimism across all altcoins, investors are moving funds from Bitcoin and into altcoins.

Starting Friday, Bitcoin (BTC) and the wider market has been under intense pressure. On Friday, the total market cap had shed nearly 10%. The price movement has cast a shadow of doubt on whether the market had found a bottom. Luckily for investors, a majority of coins led by Bitcoin held up well and did not break below critical support.

As of press, Bitcoin is down by 7% in the last 24 hours and 14% under for the week. Still trading above $21,000, investors will not be too concerned with its critical support coming at $20,000. Ethereum, whose upcoming upgrade has revived the Flippening and altseason gospel, has faired worse after losing 10% in the last 24 hours and 18% in the last seven days.

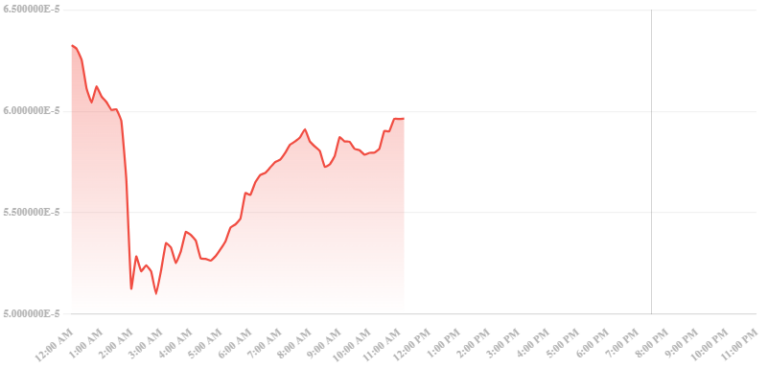

#Bitcoin prices have broken back below the Realized Price after 23 consecutive days above the market cost basis.

Realized Price currently sits at $21,700, reflecting the aggregate acquisition price, valued at the time coins last moved on-chain.

Chart: https://t.co/za5BFAI6nC pic.twitter.com/rVY5uyzKnK

— glassnode (@glassnode) August 19, 2022

As a result of the crash, on Friday, Glassnode shows Bitcoin futures long liquidations touching a new eight-month high as BTC price crashed below $22,000

What Caused the Market Crash?

With the market’s fundamental structure looking stable in the last couple of weeks, market analysts can only point to a few recent events that could have triggered the spontaneous market crash. One such key event was the de-pegging of the Huobi crypto exchange stablecoin, HUSD.

HUSD was once one of the safest stablecoins. Now it's off its peg. If HUSD doesn't return to $1, it'd be the first fully-reserved centralized stablecoin to fail. pic.twitter.com/9WmROQR6lD

— John Paul Koning (@jp_koning) August 18, 2022

The Ethereum-based stablecoin started falling below the $1 mark on Thursday. As the exchange explained later, this was a consequence of the team closing some market maker accounts in some regions to comply with regulations. By the end of Friday, the stablecoin had climbed back to $1 and the team has assured its customers that the issue had been fully resolved.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown has given a more technical reason for the recent crash. Streeter told CNBC that Bitcoin was not showing the pattern of a flash crash, as the assets didn’t immediately rebound sharply but sank even lower. Explaining what could have triggered the market leade, she noted;

It seems likely that is was as a result of a large sale transaction, in the absence of other more external factors.

In the next couple of weeks, Bitcoin faces a huge test. The Ethereum and Cardano upgrade has revived some altcoin optimism. As seen in the past, altcoins could begin to outperform Bitcoin as investors move funds from the crypto king and into altcoins that could see huge upsurges. One sign of this shifting sentiment is Bitcoin’s dominance in the market, once over 60%, this has dropped to 39% at the time of press.

Related: BITCOIN ON THE EDGE; WILL MEME COINS TAKE OVER THE CRYPTO ARENA

+ There are no comments

Add yours