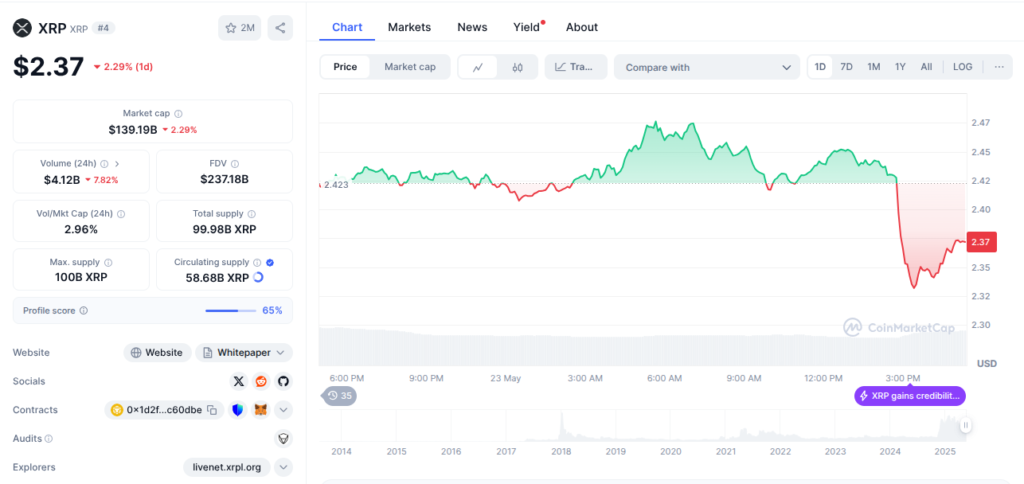

- U.S. District Judge Analisa Torres has rejected a proposed settlement between Ripple and the SEC, citing procedural flaws and leaving the original $125 million penalty and injunction in place.

- The lack of follow-up filings has deepened uncertainty among XRP investors, with the lawsuit’s resolution now facing further delays and legal complexities.

The high-stakes legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has taken another dramatic turn, dashing hopes of a swift resolution and intensifying uncertainty for XRP investors. In a surprising move, U.S. District Judge Analisa Torres has rejected a joint proposal from both parties to reduce Ripple’s financial penalties and ease restrictions on its operations. With no further filings since the decision, the crypto world is once again left in suspense.

Judge Torres Blocks Joint Agreement Over Legal Irregularities

Earlier in May, Ripple and the SEC submitted a revised settlement proposal in an attempt to soften the outcome of the long-running lawsuit. Central to the agreement was a proposed reduction in Ripple’s penalty—from the previously imposed $125 million down to $50 million. Additionally, the parties sought to lift an existing injunction that limited Ripple’s business activities, particularly concerning institutional sales of XRP.

Also read: Trump’s Crypto Gala Sparks Market Volatility and Political Backlash Amid New Anti-Crypto Bill

But Judge Torres swiftly rejected the proposal, citing “procedural flaws” that go beyond minor technicalities. Legal experts argue that the rejection speaks volumes about the judiciary’s reluctance to modify finalized judgments without solid legal grounding.

“This isn’t just about paperwork errors,” noted a former SEC enforcement attorney. “The judge made it clear that altering a final court decision requires far more than mutual consent—it requires legal rigor.”

This underscores a critical issue in securities law enforcement: final judgments, once issued, are exceptionally difficult to reverse or amend, even when both the regulator and the accused agree to do so.

Courtroom Silence Raises Alarms Among Investors

Since the judge’s decision on May 15, no new filings have been made by Ripple or the SEC, leaving stakeholders puzzled and anxious. The unexpected silence has triggered a wave of speculation across crypto forums and social media platforms. Some believe that internal disagreements may be stalling progress, while others suspect that Ripple is recalibrating its legal strategy before making another move.

For XRP holders, this radio silence is unsettling. After months of optimism driven by apparent progress toward a settlement, this legal limbo has once again thrown the future of the token—and Ripple’s broader business operations—into question.

Adding to the uncertainty is the fact that the original ruling, which includes a $125 million fine and an operational injunction, remains legally binding. Despite the joint intention to resolve the matter amicably, XRP still faces severe limitations until the court accepts any new settlement terms.

What’s Next for Ripple and the SEC?

The court’s refusal to approve the revised settlement doesn’t necessarily mark the end of the road for negotiations. However, it does indicate that any future agreement will require a far more carefully constructed legal framework to win the court’s approval. Both Ripple and the SEC are now expected to revisit the drawing board, reassess their approach, and potentially submit a new proposal that aligns with procedural and legal standards.

For XRP, the clock is ticking. The longer the case drags on, the greater the operational and reputational damage. At the same time, the SEC may also be under pressure to bring the case to a conclusion, especially amid criticism that the agency’s enforcement approach lacks consistency.

Broader Implications for the Crypto Industry

The XRP vs SEC lawsuit is widely viewed as a bellwether for future regulatory actions in the cryptocurrency space. A prolonged or unresolved outcome could set a precedent that affects how other digital assets are classified and regulated in the United States.

Furthermore, the case continues to highlight the complexities of applying decades-old securities laws to emerging technologies like blockchain. The judge’s firm stance on procedural integrity sends a strong message: regulatory clarity will not come at the cost of judicial standards.

XRP Community Awaits, Uncertainty Persists

As the legal battle grinds on with no immediate end in sight, XRP holders remain in a state of legal and financial limbo. Whether this case concludes with a settlement, a new trial motion, or further appeals, its outcome will likely resonate far beyond Ripple’s ecosystem.